If you’re self-employed, freelancing, running a side hustle, or earning money outside a traditional Form W-2, it’s time to familiarize yourself with Schedule C, Profit or Loss From Business. This form is where you report your business income, business expenses, and ultimately your net profit or loss on your federal tax return.

While Schedule C may look intimidating, you don’t have to figure it out by yourself. TaxAct® Self-Employed walks you through the form interview-style, so you’re not left staring at an IRS form wondering what all that tax jargon means.

Plus, we’ve put together a go-to tax guide for Schedule C Form 1040 filing below. This guide will walk you through who uses Schedule C, what goes on it, what you can deduct, how it ties into self-employment taxes, and common mistakes to avoid.

What is Schedule C?

IRS Schedule C reports self-employment income and expenses from a sole proprietorship or other qualifying business activity. A sole proprietorship is the simplest business entity — an unincorporated business owned by one person, in which the business and the individual running it are not legally distinct. This category can include everything from gig work and freelancing to selling products online or even babysitting.

You file Schedule C with your Form 1040 to show the IRS:

- Your gross receipts or gross income

- Your deductible business expenses

- Your net profit, which flows to your personal tax return

In plain terms, if you run a business by yourself and haven’t formed a separate tax-paying entity, Schedule C is how you tell the IRS how much money your business made (or lost) during the tax year.

Why Schedule C matters

Schedule C does more than just tell the IRS you had self-employment income. It affects your taxes in a few big ways:

- It determines your taxable income by calculating your gross income, subtracting tax deductions, and arriving at net profit.

- It impacts your self-employment taxes (Social Security and Medicare taxes).

- It helps you claim Schedule C deductions, such as mileage, supplies, software, home office costs, and more.

Who needs to file a Schedule C form?

In general, you’re required to file Schedule C if you earned $400 or more in net profit from self-employment during the tax year. Even if your income came from a small side hustle or part-time gig, crossing that $400 threshold means the IRS expects you to report it.

Common examples include:

- Freelancers and independent contractors

- Gig workers (rideshare drivers, delivery drivers, creators)

- Online sellers and resellers

- Consultants and coaches

- Small business owners with no partners or owners of single-member LLCs (for tax purposes, these usually file as sole proprietors)

You may need Schedule C self-employment income reporting if you:

- Received Form 1099-NEC

- Earned business income reported on Form 1099-K

- Collected cash, checks, or digital payments

- Had business income with no tax form issued at all

What income goes on Schedule C?

You’ll use Schedule C to report income if it comes from a business activity you operate as a sole proprietor or self-employed person. Basically, if you earned money outside a traditional Form W-2 job and you control how the work gets done, it likely belongs here. That includes:

- Gross receipts (total customer payments before expenses)

- Payments reported on Form 1099-NEC

- Payment transactions reported on Form 1099-K

- Cash, checks, tips, digital payments, and app payouts

- Some barter or non-cash payments (report these at fair market value)

The following do not belong on Schedule C:

- Wages reported on Form W-2

- Rental income (usually reported on Schedule E)

- Investment income, like interest or dividends

- Income from an S corporation you don’t directly operate

- Farm income (generally reported on Schedule F)

Tax Tip: If you collect sales tax and pass it along to your state, don’t treat that as “your income” in your bookkeeping. Many small business owners track it separately. If you lump it in with income, you’ll need to subtract it properly to avoid overstating income.

Schedule C vs Schedule E

Many taxpayers confuse Schedule C with Schedule E. Here’s a quick rundown of when to use each schedule:

- Schedule C: Use for active business activity where you provide services or sell goods as a business.

- Schedule E: Use for passive income, such as rental real estate or pass-through income from partnerships or an S corporation.

Note: If you spend time operating something like a short-term rental with hotel-like services, the line between active and passive activities can get blurry. In that case, you may want to consult a tax pro (or talk to a real tax expert with TaxAct Xpert Assist®*) to help you decide which form fits your situation.

Schedule C tax form example

Below is an example image of Schedule C, in case you want to get familiar with the layout before you start entering numbers.

When you fill out the form, you’ll generally include:

- Your business details (like business name and principal business activity)

- Income totals (including gross receipts)

- Deductible Schedule C expenses

- Special sections like cost of goods sold, vehicle info, and other expenses

- Your final net profit or loss (the number that carries to your Form 1040 and often to Schedule SE for self-employment tax)

Schedule C instructions: How to fill out Schedule C

Before we walk through how to fill out Schedule C, make sure you have the following information on hand:

- Income records: Invoices, bank deposits, platform payout summaries, Form 1099-NEC, Form 1099-K

- Expense records: Receipts, statements, software subscriptions, etc.

- Vehicle log (dates, miles, purpose) if you plan to take the mileage deduction

- Home office measurements and home expense totals, if you plan to take the home office deduction

- Your Social Security number (SSN) or your employer identification number (EIN), if you have one

Tax Tip: Use our tax checklists to ensure you’re prepared before you start filing.

Business info section

At the top of the form, you’ll enter basic details such as:

- Your business name (if you don’t have one, just put your own name)

- Your SSN or EIN

- Your principal business activity and any activity codes

- Your accounting method (cash or accrual)

- Whether you materially participated in the business

This section helps the IRS understand what your business does and how it operates.

Part I: Income

In Part I, total up your business income:

- Start with gross receipts (your total business sales)

- Subtract returns and allowances (if applicable)

- If you sell products, subtract cost of goods sold (from Part III) to get your gross profit

- Any other business income not reported elsewhere in Part I (see the IRS’s list)

This section determines your gross income before expenses.

Part II: Expenses

This is where your deductions live. The IRS calls these your ordinary and necessary business expenses.

You’ll see categories for common costs (advertising, insurance, legal/professional services, supplies, etc.). You’ll total them up to calculate total expenses, then subtract them from income to arrive at net profit.

There are two high-interest areas people often ask about in Part II:

- Home office deduction Schedule C: If you meet the business use of your home requirement, you may take a home office deduction. Depending on your situation, you may calculate it using a simplified method ($5 per square foot up to 300 square feet) or the actual expenses method.

- See our guide to the home office deduction.

- Mileage deduction Schedule C: If you use your car for business purposes, you may deduct it using either the standard mileage method (70 cents per mile in 2025) or your actual expenses (gas, repairs, insurance, depreciation, etc.), multiplied by your business-use percentage.

- See our guide to writing off your car for business use.

What expenses can you deduct on Schedule C?

Here is a list of common Schedule C deductions. Just remember to follow IRS rules and only deduct costs tied to business purposes:

| Expense type | Common examples | What to watch for |

| Advertising and marketing | Ads, promoted posts, business cards | Must relate to your business activity |

| Car and truck expenses | Standard mileage or actual expenses | Track business miles and business use percentage if you also use your car for personal use |

| Travel and meals | Lodging and transportation for business travel, ordinary and necessary client meals | Stick to IRS rules (for meals especially) and keep travel expenses and meal expenses separate on lines 24a and 24b |

| Supplies | Office supplies, shipping materials | Don’t count items exclusively used for personal use |

| Software and subscriptions | Design tools, accounting apps, cloud storage | Must be for business use |

| Phone and internet | A portion of your phone or internet bill | Deduct the business portion (not your whole plan unless it’s truly used for business-only) |

| Legal and professional services | Bookkeeper, attorney, tax software (like TaxAct) | Must be ordinary and necessary expenses directly related to your business |

| Insurance | Liability, business policies | Don’t include your personal health insurance here |

| Rent or lease | Coworking space, equipment rental | Needs a clear business connection |

| Home office | Furniture, office equipment and supplies | Must meet IRS eligibility rules |

| Equipment | Computers, tools | May involve depreciation rules |

| Taxes and licenses | Local permits, fees, property taxes on business assets | Rules can vary by location and type |

Tax Tip:If you’re also trying to claim personal itemized deductions, those usually go on Schedule A.

Part III: Cost of Goods Sold

If you sell physical products, Part III calculates the cost of goods sold (COGS). This commonly includes:

- Inventory at the beginning and end of the year

- Purchases (minus personal use items)

- Cost of labor (don’t include amounts paid to yourself)

- Materials and supplies used in production

- Other costs directly tied to producing what you sold

COGS reduces your taxable profit — just make sure you have solid records to support this section.

Part IV: Information on Your Vehicle

Part IV supports your vehicle deduction, if applicable, and tracks:

- When you started using the vehicle for business

- Total miles driven vs. business miles (commuting is not considered deductible)

- Whether you have written evidence (review what counts as adequate records in this instance)

Part V: Other expenses

Part V lets you list other expenses that don’t fit neatly elsewhere. Be specific and accurate to avoid setting off IRS red flags. Examples of expenses listed here might include:

- Amortization

- Bad debts

- Business startup costs

- Sound recording expenses

- Technology and software tools

See the IRS instructions for Part V for more examples.

Common Schedule C mistakes to avoid

When filling out Schedule C, watch out for these common issues:

- Mixing personal and business expenses

- Forgetting to report income not shown on a 1099 form (all income is technically taxable, even if you didn’t receive a tax form for it)

- Deducting 100% of a mixed-use expense (like a phone or vehicle) without calculating your business-use percentage

- Not having documentation for things like meals, travel, and vehicle mileage

- Misunderstanding cost of goods sold (inventory and COGS rules matter)

- Picking the wrong form (like Schedule A or E instead of Schedule C)

- Skipping Schedule SE when self-employment tax applies

TaxAct Self-Employed helps you sidestep these common Schedule C mistakes by guiding you through step-by-step questions about your business income, business expenses, and deductions. Instead of guessing how to complete an IRS form, you’ll answer plain-language prompts that help ensure your self-employment income and expenses are reported correctly.

Schedule C FAQs

How to file Schedule C with TaxAct

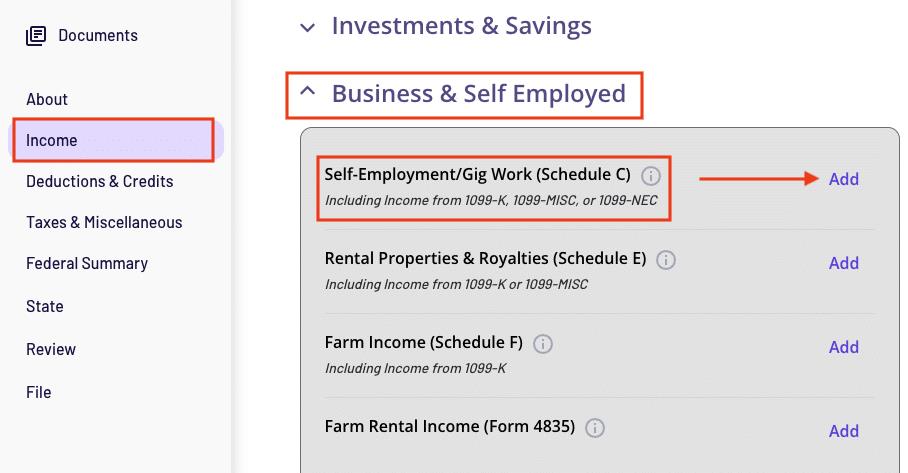

To find your Schedule C info in the TaxAct program, follow the steps below.

Note: You may receive Form 1099-NEC or Form 1099-K reporting income or transactions related to your self-employment. During the Schedule C interview process, select all applicable forms when asked about income sources that you had.

- From within your TaxAct return, click Income. On smaller devices, click the menu in the top-left corner of your screen, then make your selection.

- Expand the Business & Self-Employed section.

- Click Add beside Self-Employment/Gig Work (Schedule C) as shown in the screenshot below.

- Continue with the interview process to enter your information.

As always, TaxAct’s guided tax preparation flow helps you enter your numbers, apply eligibletax deductions, and connect your Schedule C results to the proper tax forms automatically.

The bottom line

Schedule C is where you do the bulk of your business tax reporting as a sole proprietor. It shows the IRS how much your business earned, what it cost to run, and how that income affects your tax return.

With the right records (and some help from TaxAct!), filing Schedule C with your individual Form 1040 tax return doesn’t have to be stressful. We can help you file everything correctly, claim the deductions you deserve, and move through tax season with confidence.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

* TaxAct® Xpert Assist is available as an added service to users of TaxAct’s online consumer and SMB 1120-S and 1065 products. This service is available at an additional cost and is subject to limitations and restrictions. Some tax topics or situations may not be included as part of this service. Review of customer return if requested is broad and does not include source documents. View full TaxAct Xpert Assist Terms.

The post Schedule C: How to Report Business Income & Expenses appeared first on .

Read MoreBy: Meghen Ponder

Title: Schedule C: How to Report Business Income & Expenses

Sourced From: blog.taxact.com/schedule-c-business-income-expenses/

Published Date: Thu, 05 Feb 2026 21:08:18 +0000

----------------------