If you’re involved in a pass-through entity, you’ll likely deal with Schedule K-1 at some point during tax season. Whether you’re responsible for preparing the form or waiting to receive it as a partner, shareholder, or beneficiary, understanding the ins and outs of Schedule K-1 can make tax filing season feel a lot less stressful. Keep reading to learn more about Schedule K-1, including who needs to file it, the process of preparing it, and how to file it with your tax return.

What is a Schedule K-1 tax form?

A Schedule K-1 can be used for a few different tax forms, including:

Form 1065 U.S. Return of Partnership Income

When a partnership files to report gross income, deductible expenses, capital gains, and other tax information, it also prepares a Schedule K-1. Schedule K-1 (Form 1065), otherwise known as Partner’s Share of Income, Deductions, Credits, etc., is used to report each partner’s share of business income, losses, deductions, credits, and any other tax items from a partnership. Form 1065 acts as the partnership’s tax return, while the individual partner uses the information in Schedule K-1 to file their own personal tax return.

Form 1120-S U.S. Income Tax Return for an S Corporation

S corporations file Form 1120-S to report the income, gains, losses, deductions, and credits of a domestic corporation that has elected S Corporation tax status. The S corp files this form with Schedule K-1 (Form 1120-S), Shareholder’s Share of Income, Deductions, Credits, etc., to report each shareholder’s share of the S corporation’s income, deductions, credits, and any other items. Just as with Schedule K-1 for Form 1065, the shareholders use Schedule K-1 for Form 1120-S to file their individual tax returns.

Form 1041 U.S. Income Tax Return for Estates and Trusts

Unlike the other two forms, which relate to business partnerships and corporations, estates and trusts use Form 1041. The purpose of Form 1041 is for the fiduciary of a domestic’s estate, trust, or bankruptcy estate to report the entity’s income, deductions, gains, losses, and tax liability. Schedule K-1 (Form 1041), Beneficiary’s Share of Income, Deductions, Credits, etc., reports the beneficiary’s share of income, credits, and deductions from the trust or decedent’s estate, which the beneficiary uses in their personal income tax return.

Who needs to file Schedule K-1?

When a partnership, S corporation, estate, or trust files Form 1065, 1120-S, or 1041, respectively, they must also prepare Schedule K-1s for their partners, shareholders, or beneficiaries. The recipients of the Schedule K-1s aren’t responsible for preparing the forms.

For Form 1065 and 1120-S, the partnership or S corporation usually prepares the Schedule K-1 for the partner or shareholder through an accountant or tax professional.

In the case of Form 1041, the fiduciary is responsible for filing Schedule K-1. A fiduciary, such as an executor, trustee, or administrator, is legally obligated to ensure Internal Revenue Service compliance for the estate or trust. The fiduciary must prepare Schedule K-1 with the Form 1041 tax document for each beneficiary who received, or is entitled to receive, a share of the estate or trust’s income, deductions, or credits.

You can easily file and distribute Schedule K-1s of all three types for each individual with TaxAct®.

How do you file a Schedule K-1?

At first glance, the IRS form may look overwhelming, but each type follows a similar format. The respective form (1065, 1120-S, or 1041) and Schedule K-1 are generally filed together, and the process typically looks like this:

- The partnership/corporation/fiduciary completes Form 1065/1120-S/1041

- The partnership/corporation/fiduciary prepares Schedule K-1s for each partner/shareholder/beneficiary

- The Schedule K-1s are filed with the IRS as part of Form 1065/1120-S/1041

- Copies of the Schedule K-1s are distributed to each partner/shareholder/beneficiary

Check out TaxAct’s checklists for Form 1065, Form 1120-S, and Form 1041, for everything you need to prepare when filing.

How to file Schedule K-1 with your tax return in TaxAct®

With TaxAct, you can easily report your income from your Schedule K-1s on your individual tax return. Follow these steps for reporting your Partnership and/or S Corporation Income on your tax return:

- From within your TaxAct return, click Income.

- On smaller devices, click the menu at the top left corner of your screen, then make your selection.

- Click the Business & Self Employed drop-down.

- Click Add beside Partnership Income (Schedule K-1) or S-Corporation Income (Schedule K-1) as shown in the screenshot below.

- Complete the rest of the interview process.

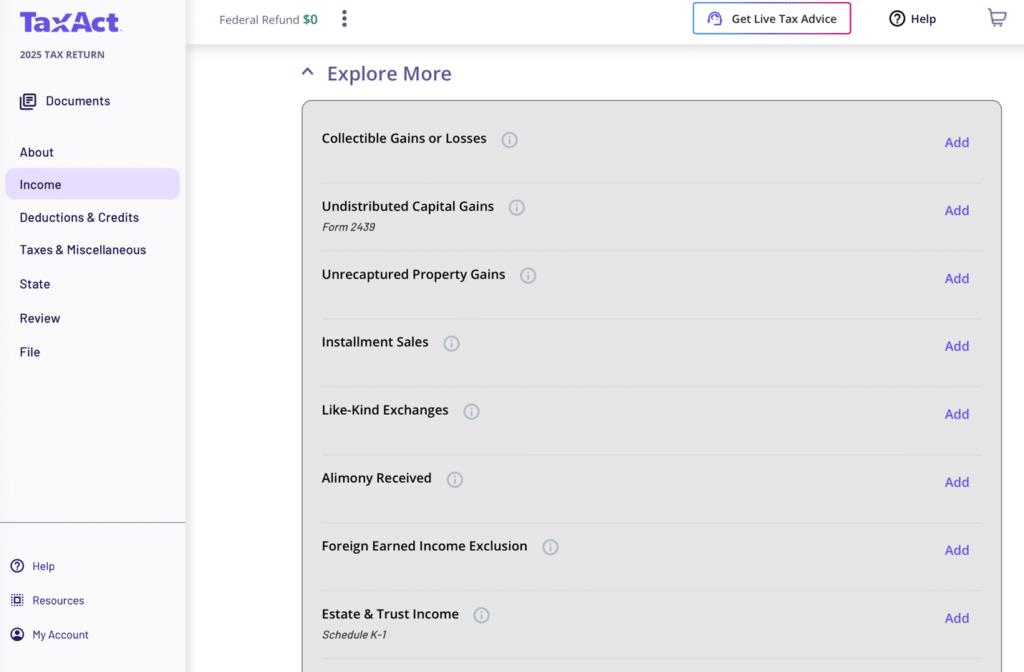

Follow these steps if you’re reporting your Estate and Trust Income on your tax return:

- From within your TaxAct return, click Income.

- On smaller devices, click the menu at the top left corner of your screen, then make your selection.

- Click the Explore More drop-down.

- Click Add beside Estate & Trust Income (Schedule K-1) as shown in the screenshot below.

- Complete the rest of the interview process.

When is Schedule K-1 due?

The due date for Schedule K-1 depends on the form it’s associated with.

Deadline for Form 1065 and Form 1120-S

The due dates for these Schedule K-1s depend on whether the partnership or S corporation uses a calendar-year or a different fiscal-year method, and whether the entity files for an extension.

If the entity follows the calendar year, the Schedule K-1 will be due by March 15, and by Sep. 15 if an extension has been filed. However, if following a different fiscal year, the due date for the Schedule K-1 lands on the 15thday of the third month after the fiscal year ends. If the entity files for an extension, the Schedule K-1 is due on the 15th day of the ninth month following the end of the fiscal year.

Note: If the deadline falls on a weekend or holiday, it will be moved to the following business day.

Deadline for Form 1041

Form 1041 must be filed by the 15th day of the fourth month after the close of the trust or the estate’s tax year.

FAQs

The bottom line

Partnerships, S corporations, and estates or trusts use Schedule K-1s to report each partner’s, shareholder’s, or beneficiary’s share of income, deductions, and credits. Pass-through entities prepare Schedule K-1s along with their primary tax returns (Form 1065, Form 1120-S, or Form 1041). Then, they provide copies to the taxpayers who need the information to complete their personal tax returns.

While Schedule K-1 can seem complicated at first, the process is much more manageable with the right tools. Use TaxAct to enter your Schedule K-1 information accurately and file with confidence. Spend less time worrying about forms and more time focusing on what matters most.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

The post What Is a Schedule K-1?: A Guide and Instructions on How to File appeared first on .

Read MoreBy: Erin Mckendrick

Title: What Is a Schedule K-1?: A Guide and Instructions on How to File

Sourced From: blog.taxact.com/guide-to-schedule-k-1/

Published Date: Fri, 30 Jan 2026 19:27:15 +0000

----------------------