Sometimes, life throws you a curveball, and you’re suddenly staring at a tax form you’ve never seen before — like IRS Form 1099-LS. Let’s look at why a 1099-LS form appeared in your mailbox this tax year and what to do with it when filing your taxes.

At a glance:

- Form 1099-LS reports the sale of a life insurance policy, but this doesn’t always mean you owe taxes.

- If your proceeds exceed your tax basis, they may be taxed as ordinary income or capital gains.

What is Form 1099-LS?

You may get Form 1099-LS, Reportable Life Insurance Sale, if you sell or transfer your life insurance contract to another party Due to current 1099-LS requirements, this is a reportable policy sale, and the buyer must report this transaction to the Internal Revenue Service (IRS). Selling a life insurance policy may have tax implications, which is why the IRS wants to know about it.

Form 1099-LS scenarios

To better understand this tax form, let’s examine some examples that may trigger Form 1099-LS.

- Life settlement: You sell your life insurance policy to a life settlement company for cash. After the sale, the life settlement company sends you Form 1099-LS to document the transaction.

- Viatical settlement (terminal illness sale): You are diagnosed with a terminal illness and sell your life insurance policy to a viatical settlement provider in exchange for a cash payment. The provider sends you Form 1099-LS to report the transaction.

- Transferring a policy: You are a business owner with a key person life insurance policy (meaning the business owns the policy). You decide to cash out and transfer the policy to your business partner. Your business partner files Form 1099-LS and sends you a copy.

How life insurance settlements are taxed

Note that 1099 forms are only considered information returns — cashing out a life insurance policy doesn’t automatically mean you owe taxes.

As the seller of the policy, you may also receive Form 1099-SB, Seller’s Investment in Life Insurance Contract, from the life insurance issuer (or broker). This form will have details about your cost basis in the contract and the settlement amount. You can use this form along with your 1099-LS to figure out if the policy sale resulted in a taxable gain.

Here are the possible scenarios you could be looking at:

- No tax owed: If the amount you received does not exceed your tax basis (for instance, the total amount of premiums you paid over time), it is not taxable.

- Ordinary income: If the amount you received does exceed your basis, the extra amount — up to the policy’s cash surrender value — is taxed as ordinary income.

- Capital gains: Any remaining proceeds are taxed as capital gains.

- Capital loss: If you sell the policy for less than your basis, you have a capital loss. Losses can be used to lower your taxable income.

Tax Tip: The IRS has a useful calculator to help you determine whether life insurance proceeds are taxable.

Example of Form 1099-LS

Here’s a 1099-LS form example. As the payment recipient, you should receive Copy B:

On this form, you’ll find:

- The recipient’s name and contact info: The form will include your taxpayer identification number (TIN), name, and contact information. Your TIN is often your Social Security number.

- The acquirer’s information: This is the entity that bought your policy — you’ll see their TIN and contact info on the form as well.

- Policy details: Information about the life insurance policy, including the policy number.

- Amount paid to payment recipient (Box 1): This is the amount the buyer paid for the policy.

- Date of sale (Box 2): The date the buyer bought the policy from you.

Instructions for Form 1099-LS

Now that you’ve got your 1099-LS form in hand, it’s time to figure out what to do with it. Here’s what you need to do:

- Review the information: Double-check that all details on the form are correct and contact the issuer if you notice any discrepancies.

- Determine if you have a taxable event: The 1099-LS form details the sale of a life insurance policy, which could have tax implications (but not always). If the proceeds need to be reported, TaxAct® can help you do so when you e-file with us.

- Consult a tax professional: If this all sounds a bit too complex, don’t hesitate to consult a tax expert or use tax preparation software like TaxAct, which can guide you through the reporting process step-by-step.

FAQs about Form 1099-LS

How do you report 1099-LS transactions?

You’ll report the proceeds from your 1099-LS form on your income tax return in one of two ways. Any proceeds taxed as ordinary income must be reported under the “Other Income” section of Form 1040. Proceeds taxed as capital gains must be reported on Schedule D. TaxAct can help you with both methods (more on that in the next section).

Why did I also get Form 1099-SB?

If you received Form 1099-LS this year, you might also have gotten Form 1099-SB. The buyer (acquirer) sends you Form 1099-LS to report the life insurance sale. Meanwhile, the life insurance carrier that issued the policy sends you (the seller of the policy) Form 1099-SB. On Form 1099-SB, you’ll find information about your investment in the life insurance contract and the settlement amount (what you sold the policy for), which you can use to determine if the life insurance sale has tax implications.

When is the due date for 1099-LS forms?

The IRS requires acquirers to send out Form 1099-LS to filers by Jan. 31, meaning you should see it in your mailbox by mid-February. Unless you request a tax extension, you should report any taxable income by the Tax Day deadline, which typically falls on April 15.

How to file Form 1099-LS with TaxAct

Filing taxes often feels like running a marathon, but TaxAct can help you cross the finish line. Here’s how you can file your 1099-LS form with TaxAct:

To report ordinary income:

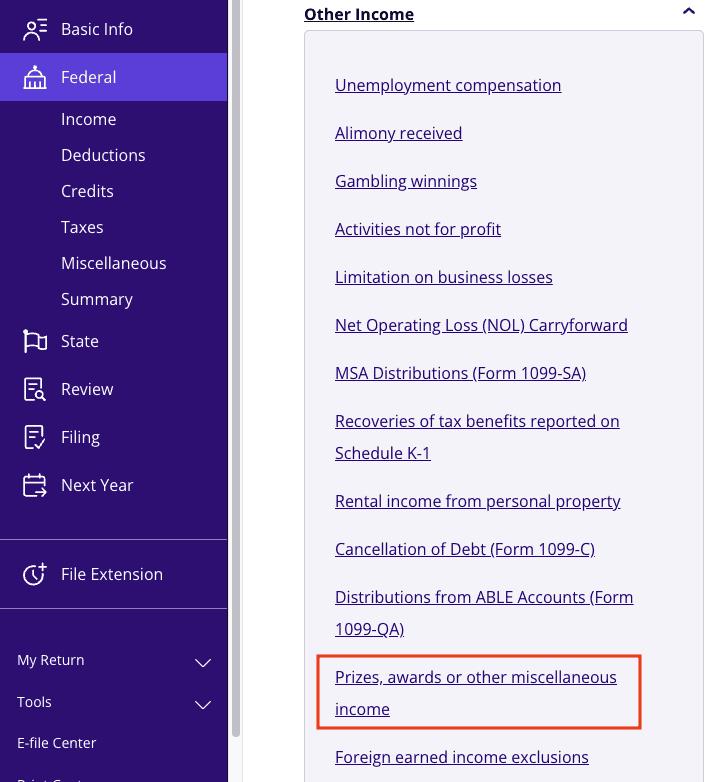

- Click Federal in the left navigation.

- On the Federal Quick Q&A Topics screen, click Other Income to expand the category.

- Click Prizes, awards or other miscellaneous income as shown below.

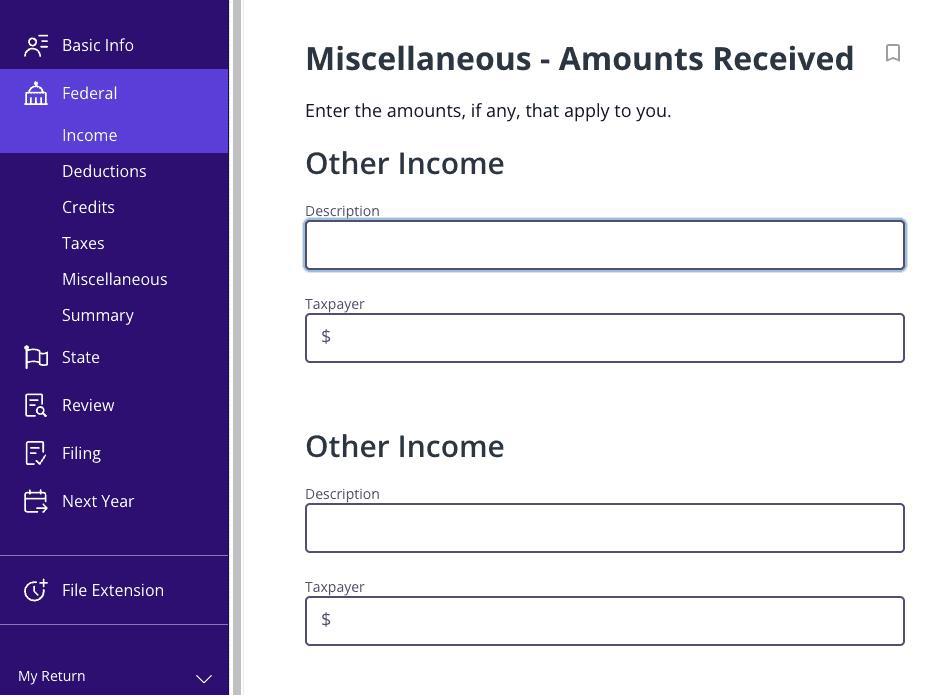

4. Enter the amount and description in one of the two Other Income lines as shown below.

To report capital gains:

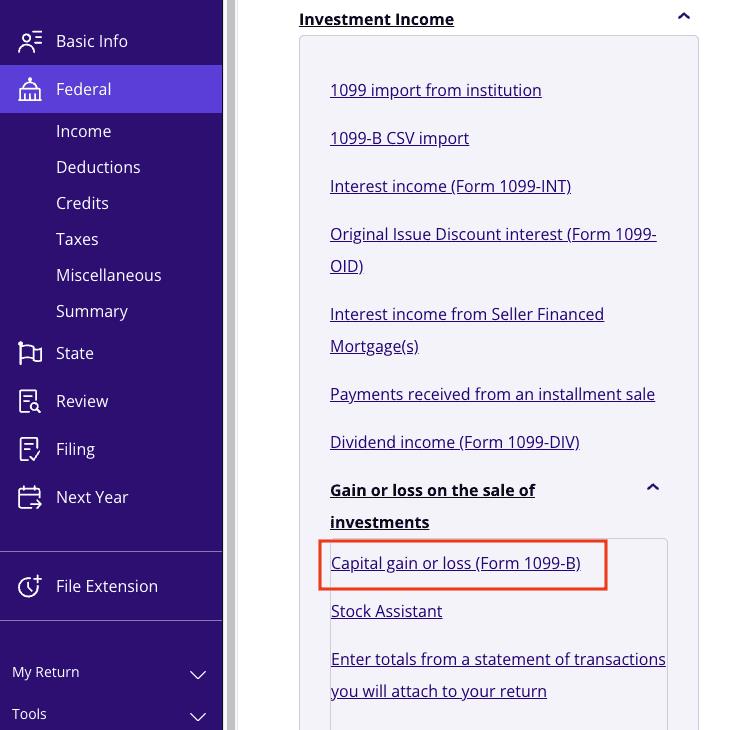

- Click Federal in the left navigation.

- On the Federal Quick Q&A Topics screen, click Investment Income to expand the category.

- Click Gain or loss on the sale of investments to expand the category.

- Click Capital gain or loss (Form 1099-B) as shown below.

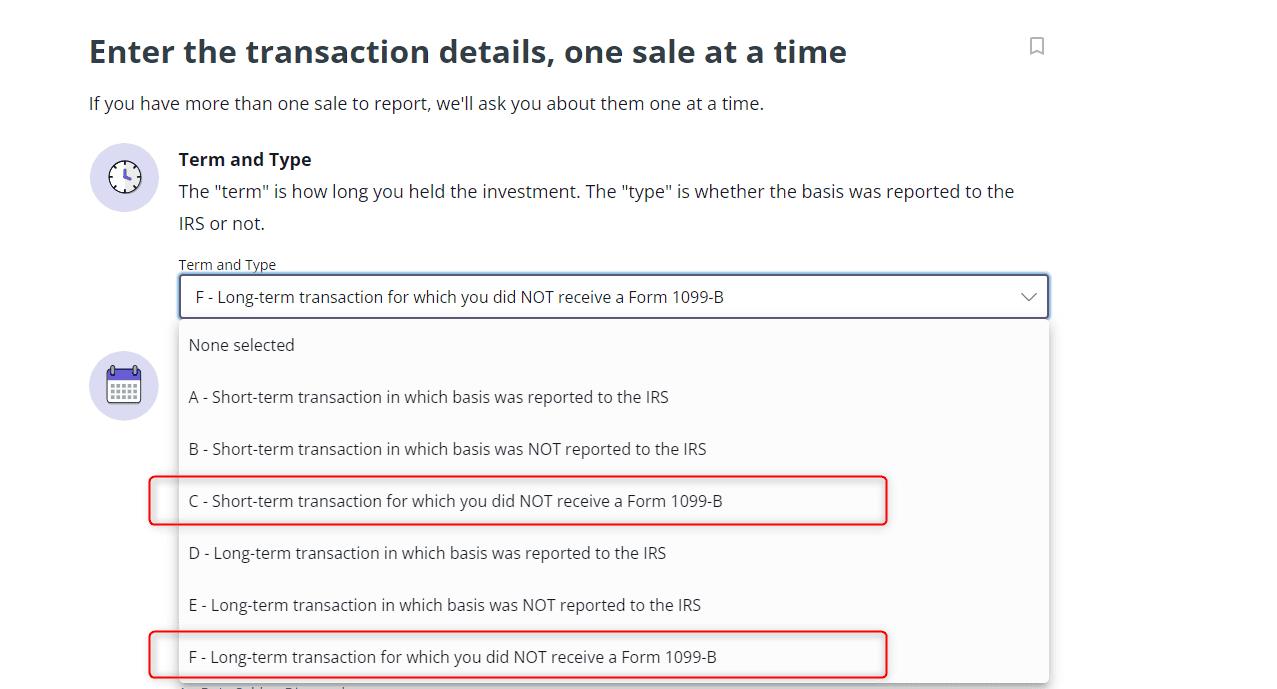

5. Proceed with entering the transaction details. Under Term and Type, you’ll be able to select whether it was a short-term gain or long-term gain for which you did not receive a Form 1099-B, as shown below:

Tax Tip: If you held the life insurance policy for longer than one year, it’s a long-term capital gain. In contrast, if you held it for one year or less, it’s a short-term gain.

The bottom line

Form 1099-LS might not be the most common tax document out there, but if you’ve received one, it’s important to handle it correctly. By understanding what this form is, what it includes, and how to report it on your taxes, you can avoid unnecessary stress and ensure you’re in good standing with the IRS. And remember, TaxAct is here to make the tax filing process as smooth as possible.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

The post Form 1099-LS: What It Is and How to Use It appeared first on TaxAct Blog.

Read MoreBy: Meghen Ponder

Title: Form 1099-LS: What It Is and How to Use It

Sourced From: blog.taxact.com/guide-to-1099-ls-form/

Published Date: Mon, 23 Sep 2024 15:57:37 +0000

----------------------