If you recently started an LLC or small business, you’ve probably heard you can write off a vehicle for tax purposes. And that’s true! But the process isn’t as simple as buying a car and calling it a business expense. Whether you use your car a few days a week for client meetings or drive for business full-time, there are multiple ways to write off car-related expenses depending on how you use the vehicle, how you purchased it, and how well you keep records.

In this guide, we’ll break down how the IRS handles business vehicle tax deductions, explain your tax write-off options, and walk you through choosing the best method for your situation. We’ll also get into depreciation rules, section 179, bonus depreciation, and how to claim it all using TaxAct®.

Who can write off a car as a business expense?

Not every vehicle qualifies for a tax deduction, and not every business owner can claim one. The IRS has clear rules about who can write off a car purchase or ongoing vehicle expenses — and it all starts with how the vehicle is used.

You can generally claim a vehicle deduction for your LLC or other business type if:

- You’re a sole proprietor, part of a partnership, or operating as an LLC, S corp, or corporation.

- You’re self-employed or earn business income through freelance, contract work, gig work, or owning a small business.

- The vehicle is used for business purposes, such as driving to client meetings, hauling equipment, or making deliveries.

But here’s the catch: The IRS only lets you deduct the business-use portion of the car. For example, if you use it 80% for business purposes and 20% for personal use, you can only deduct 80% of the eligible vehicle expenses.

Now that we’ve covered who qualifies, let’s dive into how the deduction works.

When can you write off taxes on a car?

You can only write off your car on your federal tax return if you’re using it for actual business purposes, not just cruising to the office every morning.

Here are some examples of what counts as qualifying business travel for an auto deduction:

- Driving to meet with clients

- Heading out to visit job sites

- Making deliveries for your small business

- Traveling between different office locations

Does my commute count toward business miles?

Regular commuting (the drive from your home to your main office) isn’t considered business mileage. The IRS treats that as a personal expense, even if you take work calls the whole way there.

However, if your home is your primary place of business — say, you’re a self-employed consultant working out of a home office — and you drive to meet clients or visit worksites, your travel could qualify for a business mileage deduction.

How to write off a car for business tax deductions

How you deduct your vehicle and any related expenses depends on your chosen deduction method. The IRS gives you two options: the standard mileage rate or the actual expense method.

Standard mileage vs. actual expenses: What’s the difference?

1. Standard mileage rate

This method is simpler than calculating actual expenses. To figure your deduction, simply multiply the business miles you drove during the tax year by the IRS standard mileage rate for businesses.

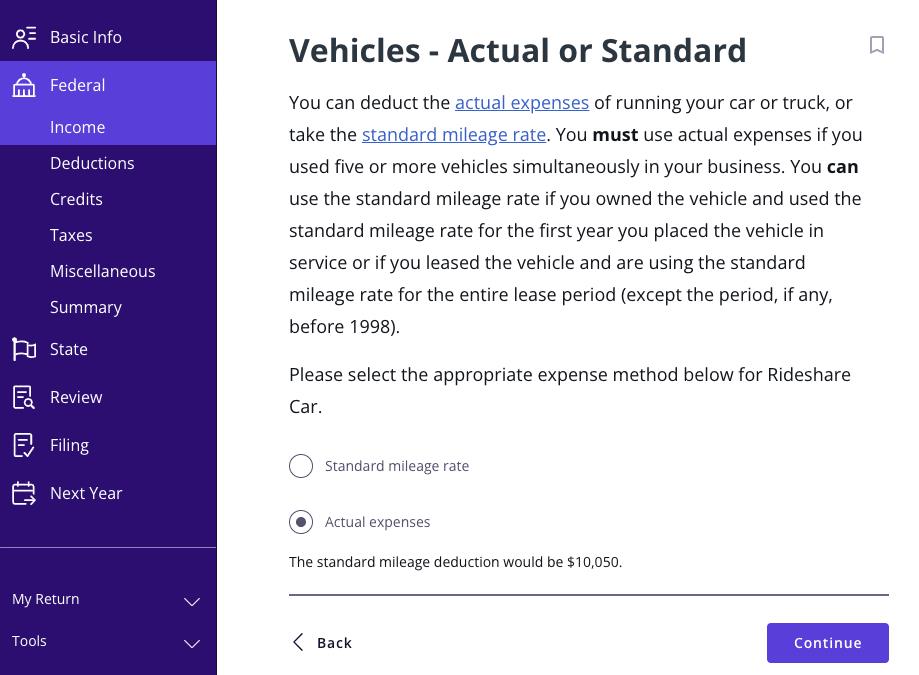

- For 2024, the standard mileage rate was 67 cents per mile.

- For 2025, the standard mileage rate is 70 cents per mile.

This flat rate includes most of your car expenses — depreciation, gas, maintenance, and other typical vehicle expenses. You can’t deduct those items separately if you use this method.

However, you can still deduct some additional costs not built into the standard mileage rate, including:

- Car registration fees and property taxes

- Parking and tolls

- Auto loan interest paid

When the standard mileage rate isn’t allowed

You can’t use the standard mileage rate if you:

- Use five or more cars at the same time (such as in fleet operations).

- Claimed a depreciation deduction for the car using any method other than straight line for the car’s estimated useful life.

- Used the Modified Accelerated Cost Recovery System (MACRS).

- Claimed a section 179 deduction (discussed later) on the car.

- Claimed the special bonus depreciation allowance (discussed later) on the car.

- Claimed actual car expenses after 1997 for a car you leased.

Standard mileage rate example

Say you drove 15,000 business miles in 2024. Here’s how you would calculate your deduction using the standard mileage method:

15,000 miles x $0.67 (the 2024 standard mileage rate) = $10,050 deduction.

Need help crunching the numbers? Our Mileage Reimbursement Calculator makes it easy to estimate your deduction using the standard mileage rate.

Tax Tip: To use the standard mileage rate in future years, you must use it in the first year of business use. If you claim actual expenses in the first year, you’re stuck with it — you can’t switch to the standard method later. However, starting with the standard mileage rate allows you to switch between methods in future years (unless you’re leasing the car).

2. Actual expense method

This method takes more work but can sometimes yield a bigger deduction depending on your circumstances.

To calculate your deduction using actual expenses, you’ll need to track and add up everything it costs to operate the car. This can include:

- Gas and oil costs

- Insurance

- Garage rent

- Repairs and maintenance

- Depreciation (if you own the vehicle) or lease payments

- Section 179 deduction

- Registration fees and taxes

- Parking and tolls

- Auto loan interest paid on car payments

Once you’ve calculated the total cost of all the above, multiply it by your business-use percentage.

Actual expenses example

Let’s say your total vehicle expenses were $12,000 in 2024. You drove 20,000 miles, and 15,000 (or 75%) of those were for business purposes, just like the example we used for the standard mileage rate.

Your business miles determine your business use percentage, which determines your deduction percentage. Here’s how you would calculate your deduction:

$12,000 actual expenses x 75% (business use percentage) = $9,000 deduction.

Tax Tip: If you want to use section 179 expensing or bonus depreciation (more on these below) in the first year you placed the vehicle in service, you must use the actual expenses method and cannot switch to the standard mileage rate in future years.

Which method is better?

Neither deduction method is inherently better than the other — it all depends on your situation. As you can see from the examples we used, even though the business miles were the same in both examples, the standard mileage rate resulted in a larger deduction in this case.

How to choose: standard mileage rate vs. actual expenses

- If you drive a lot of business miles and your car is relatively inexpensive to maintain, the standard mileage rate might be easier and just as valuable (or more valuable!).

- If your car is new, expensive, or used mostly for business, the actual expense method (including claiming section 179) might give you a higher deduction — but it requires more meticulous recordkeeping.

For both methods, you’ll need to track your business vs. personal use by keeping a business mileage log.

Still not sure which method is better for you? Don’t be afraid to consult a CPA or tax professional for advice!

Claiming section 179 and bonus depreciation for your business vehicle

What is the section 179 deduction?

Section 179 allows small business owners and self-employed taxpayers to deduct the cost of qualifying business vehicles in the first year they’re placed in service, instead of spreading that depreciation over several years. This can result in significant tax savings — but only if your vehicle qualifies.

Who qualifies for section 179?

To qualify for the section 179 depreciation deduction, the vehicle must be:

- New or used (but new to you)

- Purchased and put into service during the same tax year

- Used more than 50% of the time for business purposes

Section 179 deduction vs. bonus depreciation

Bonus depreciation (also called the special depreciation allowance) is another accelerated form of depreciation. But it differs slightly from section 179:

- While section 179 allows you to deduct a set dollar amount, bonus depreciation lets you deduct a fixed percentage of the vehicle’s cost (up to 40% in 2025).

- Bonus depreciation can exceed your business income to create a net loss, while section 179 is limited to your taxable income.

To qualify for bonus depreciation, you must meet all the following tests:

- You acquired the car after Sept. 27, 2017.

- You bought the car either new or used.

- You placed the car in service in your trade or business before Jan. 1, 2027.

- You used the car more than 50% of the time for business purposes during the tax year.

Can I take section 179 and bonus depreciation in the same year?

Yes, as long as you meet the requirements for both. However, you must take section 179 deductions before taking bonus depreciation. For example, you can deduct the cost up to the annual limit with section 179 and then use bonus depreciation on the remainder.

Deduction limits based on vehicle type

The IRS categorizes vehicles into three types for section 179: light, heavy, and other. The gross vehicle weight rating (GVWR) determines these categories, and each type has different deduction limits.

Light vehicles (under 6,000 pounds GVWR)

- Includes many sedans, crossover SUVs, and compact pickups.

- In 2024, the maximum section 179 deduction for light vehicles is $12,400. If you used your car 100% for business, this is the maximum deduction amount you can claim.

- You can also apply bonus depreciation. For light vehicles, bonus depreciation can add up to $8,000 more for a total potential first-year deduction of $20,400.

Heavy vehicles (6,000 to 14,000 pounds GVWR)

- Includes many full-size SUVs, cargo vans, and heavy-duty pickups.

- For 2024, the section 179 deduction amount limit for heavy vehicles is $30,500. For 2025, the maximum deduction increases to $31,300.

- These vehicles also qualify for bonus depreciation — you can deduct up to 60% of the vehicle’s purchase price in 2024 or 40% in 2025.

Other vehicles (special-use or over 14,000 pounds GVWR)

- Includes shuttles, delivery vans with long cargo areas, hearses, and vehicles with no seating behind the driver.

- Vehicles that meet these criteria have no section 179 deduction limit. You can deduct up to 100% of the cost if used exclusively for business purposes.

You can find the full list of depreciation limits for vehicles in IRS Publication 463.

Tax Tip: If you only claim part of the cost of a qualifying vehicle under section 179 or bonus depreciation, you can usually depreciate the rest over time using regular depreciation deductions.

Section 179 calculation example

Let’s say you buy a used car in September 2024 for $15,000. The vehicle’s GVWR is 3,500 (light vehicle), and you use it 60% for your business. Here’s how the section 179 deduction would work:

- First, figure out the business use cost:

$15,000 purchase price × 60% business use = $9,000 business use cost. - Next, check the Section 179 limit for light vehicles:

In 2024, it’s capped at $12,400.

60% of $12,400 = $7,440. - That means your Section 179 deduction for 2024 is $7,440.

For the leftover amount of your business use cost ($9,000 – $7,440 section 179 deduction = $1,560), you can take bonus depreciation if your vehicle meets the requirements. If not, you can carry forward the remaining $1,560 to depreciate in future years starting in 2025.

Using IRS Form 4562 to claim vehicle deductions

If you claim section 179 or bonus depreciation, you must file IRS Form 4562 with your income tax return. This form covers depreciation and amortization for business assets.

TaxAct makes this part easy — you’ll enter your vehicle details during our tax preparation software’s guided interview, and it’ll automatically generate Form 4562 and attach it to your return.

Business vehicle recordkeeping tips

No matter which deduction method you choose, keeping detailed and accurate vehicle records is important. That includes:

- A mileage log (with date, destination, purpose, and total miles driven)

- Receipts for gas, insurance, repairs, and other expenses

- Odometer readings at the start and end of the year

- Purchase or lease agreements if you’re depreciating the vehicle

Remember, the IRS won’t just take your word for it. You’ll need this documentation to back up your deduction if you happen to get audited. If you need help, IRS Publication 463 has a section on how to prove vehicle expenses.

How to write off a business vehicle with TaxAct

No matter which method you choose, TaxAct’s tax preparation software walks you through claiming a vehicle deduction step-by-step.

Here’s how you can enter vehicle expenses when e-filing with us:

- From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

- Click the Business Income dropdown, then click Business income or loss from a sole proprietorship as shown below.

- Click + Add Schedule C to create a new copy of the form or click Edit to edit a form already created. (Desktop program: Click Review instead of Edit.)

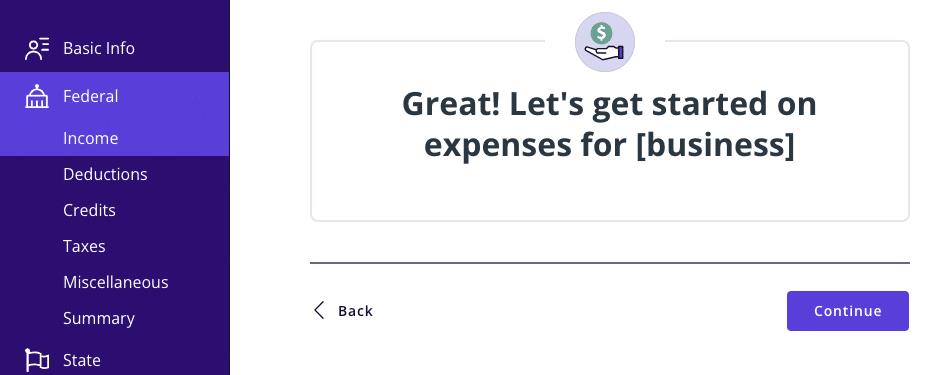

- Continue with the interview process until you reach the screen titled Great! Let’s get started on expenses for [business], as shown below.

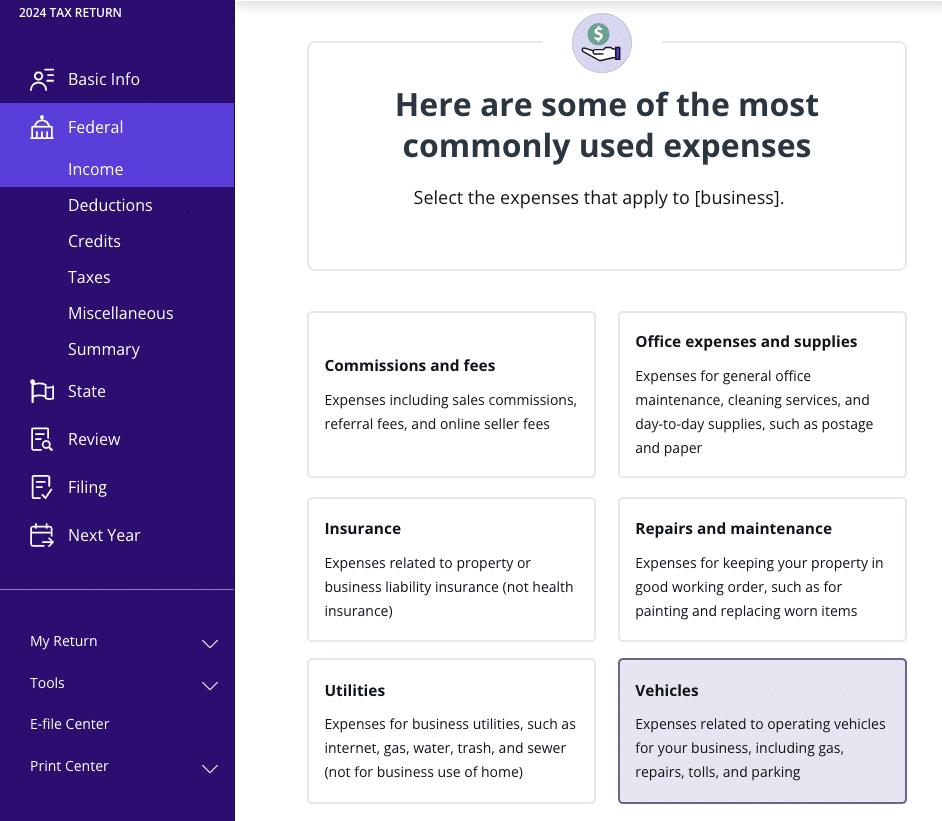

- You will have the option to select your expenses as shown below.

- Continue until you reach the screen titled Vehicle Expenses – Actual or Standard, as shown below. Here you can pick which deduction method you want to use.

- Continue with the interview process by entering your vehicle expense information. We’ll provide guidance and helpful prompts to ensure you don’t miss anything.

Business vehicle deduction FAQs

Can I deduct a leased vehicle?

Yes. Lease payments can be deducted based on the business-use percentage of the vehicle (determined by how many business miles you drove).

You can use the standard mileage rate or actual expenses for leased vehicles. But if you use the standard mileage rate for a car you lease, you must choose to use it for the entire lease period (including renewals).

If you use actual expenses, you’ll typically deduct your lease payments instead of depreciation, unless you have a conditional sales contract (like a lease-to-own agreement). Check if your agreement qualifies as a lease or conditional sales contract on irs.gov.

What if I finance the vehicle?

You can still deduct depreciation and interest payments on the business portion of the loan. The entire purchase price isn’t deductible at once unless you qualify for section 179 and/or bonus depreciation.

Can I switch deduction methods later?

Only if you used the standard mileage method in the first year. If you use actual expenses first, you can’t switch to standard mileage later.

Can I still take the section 179 deduction if I use my vehicle for personal use?

Yes! But you must use the vehicle more than 50% of the time for business purposes and take a partial deduction proportional to your business use percentage. You’ll need to track mileage and expenses to determine that percentage.

What if I just started using my personal car for my business?

Unfortunately, you can’t take a section 179 deduction for a personal car that you’ve owned for a while and converted into a business vehicle. Section 179 is only available for cars purchased and placed in service for business during the same year. However, you can still take advantage of the standard mileage deduction!

What if I use my car 50% or less for business?

According to the IRS, if you only use your car 50% or less for business:

- You can’t take the section 179 deduction.

- You can’t take the special depreciation allowance (bonus depreciation).

- You must figure depreciation using the straight line method over a 5-year recovery period. You must continue to use the straight line method even if your percentage of business use increases to more than 50% in a later year.

For more info, check out IRS Publication 463.

I never claimed section 179 for my vehicle, even though I could have. What do I do?

If you failed to claim the section 179 deduction the year you purchased the vehicle, you will need to file an amended return for that year (plus any following years, if applicable).

Can I take the section 179 deduction for a pre-owned vehicle?

Yes, both new and used vehicles qualify, as long as the vehicle is new to you.

Where do I find my vehicle’s GVWR?

The GVWR is typically listed on the manufacturer’s sticker inside the driver’s side door. It includes the vehicle’s weight, passengers, cargo, and accessories. But check carefully — some models are “borderline,” meaning small differences in trim (like extended cab vs. crew cab) can be the difference between a light vehicle and a heavy vehicle.

Do electric vehicles qualify for the same tax benefits?

Yes, electric vehicles can qualify for the same deductions. Plus, if you bought a qualifying electric vehicle, you may be able to claim the EV tax credit if you meet IRS eligibility requirements.

The bottom line

If you understand how your vehicle is used for business purposes, choose the right deduction method, and keep detailed records, you’ll be in a great spot to lower your taxable income and maximize your tax savings. Remember, choosing the right vehicle deduction method in your first year and maintaining good recordkeeping can greatly affect your overall tax bill.

When you’re ready to file, TaxAct makes it easy. Our step-by-step guidance can help you claim the right tax deductions for your business vehicle without the headaches. We’ll help you file confidently, maximize your savings, and make sure you don’t leave any money on the table.

And if you’re still unsure about the best way to write off your business vehicle, don’t forget about Xpert AssistTM. We have credentialed tax experts on hand who can help answer questions you may have when filing.1

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

1 Tax Experts are available with TaxAct® Xpert Assist®, which encompasses a suite of services designed to provide varying levels of support and assistance for your tax filing needs. These services are available at an additional cost and are subject to limitations and restrictions. Service availability, features, and pricing may vary and are subject to change without notice. For more details, read full terms.

The post Can an LLC Write Off a Car Purchase? How to Write Off a Car for Business Tax Deductions appeared first on .

Read MoreBy: Meghen Ponder

Title: Can an LLC Write Off a Car Purchase? How to Write Off a Car for Business Tax Deductions

Sourced From: blog.taxact.com/how-to-write-off-car-for-business-tax-deduction/

Published Date: Fri, 16 May 2025 16:50:47 +0000

----------------------