If you’re a parent or caregiver, you’ve probably heard about the Child Tax Credit (CTC). It’s one of the biggest tax breaks out there for families, and it can significantly reduce the amount you owe (or even boost your tax refund!). However, being a parent is just one of several requirements to claim this tax credit.

So, let’s break it down. We’ll go over what the Child Tax Credit is, who qualifies, and how to claim the CTC on your federal income tax return.

At a glance:

- The Child Tax Credit is worth up to $2,000 per qualifying child under age 17 for 2024 and 2025.

- Income limits apply — the full credit is available for those earning under $200,000 (or $400,000 if married filing jointly).

- Up to $1,700 of the credit may be refundable if you meet certain income requirements.

- You’ll need to file a tax return to claim the credit.

What is the CTC?

The Child Tax Credit is a federal tax benefit designed to help taxpayers with the costs of raising children. It reduces your tax bill on a dollar-for-dollar basis, which means it’s not just a tax deduction — it’s a direct credit against what you owe.

For 2024 and 2025, the credit has returned to pre-2021 levels after the temporary expansion under the American Rescue Plan Act ended. That means:

- The base amount is up to $2,000 per qualifying child under age 17 at the end of the tax year.

- A portion of the credit may be refundable — more on that in a bit.

Who qualifies for the Child Tax Credit?

To claim the federal Child Tax Credit, you and your child need to meet certain eligibility criteria. Here’s what that looks like.

To be considered a qualifying child, your dependent child must:

- Be under age 17 at the end of the tax year.

- Be your biological child, stepchild, foster child, sibling, stepsibling, or a descendant of any of these (like a grandchild, niece, or nephew).

- Have lived with you for more than half the year.

- Not have provided more than half of their own financial support.

- Be a U.S. citizen, national, or U.S. resident alien.

- Have a valid Social Security number (SSN). Having an individual taxpayer identification number (ITIN) is not enough to claim the CTC.

To meet the eligibility requirements, you must:

- Claim the child as a dependent on your tax return.

- Meet the income requirements (see below).

Child Tax Credit income limit for 2025

The full Child Tax Credit is available for filers under specific income thresholds. Once your modified adjusted gross income (MAGI) goes above a certain amount, the credit begins to phase out.

Here are CTC income limits for both 2024 and 2025:

| Filing status | Phaseout begins at |

| Married filing jointly | $400,000 |

| Single or head of household | $200,000 |

| Married filing separately | $200,000 |

Your credit gets reduced by $50 for every $1,000 (or part of $1,000) above these limits.

CTC qualifications at a glance

How much is the Child Tax Credit for 2025?

The maximum Child Tax Credit amount for 2024 and 2025 is $2,000 per qualifying child.

Note: The Tax Cuts and Jobs Act (TCJA) set this amount from 2018 through 2025. If Congress does not expand the TCJA past 2025, the CTC will revert back to the pre-2018 amount of $1,000 per child. As changes happen, we will update this page accordingly!

Is the Child Tax Credit refundable?

The CTC is only partially refundable, meaning:

- You can use the credit to lower your tax bill to $0.

- If you still have unused credit left, you might get a refund through the Additional Child Tax Credit (ACTC) — but only up to the refundable limit. The refundable portion ensures low-income families can still take advantage of the credit, even if they don’t earn enough to owe taxes.

- For 2024 and 2025, the maximum refundable amount per child is $1,700.

Still got questions? Read our full ACTC guide here.

How to get the Child Tax Credit

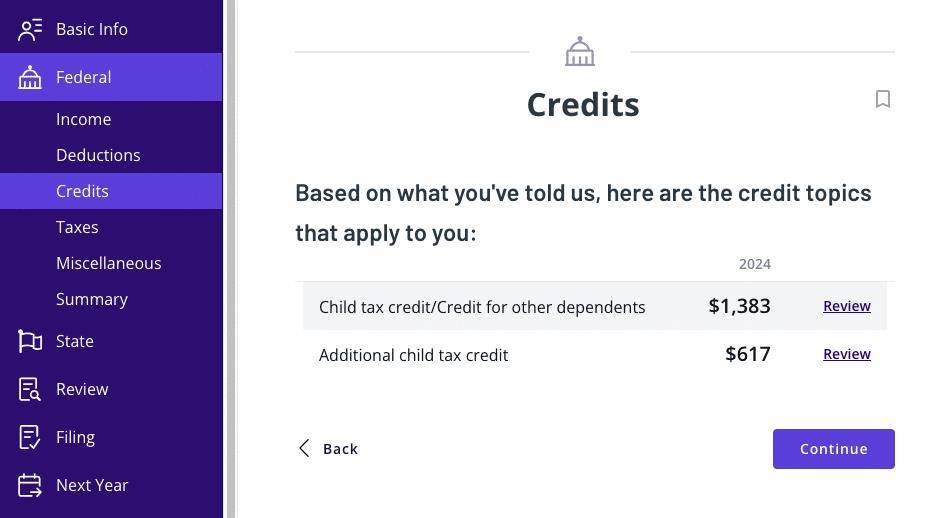

Claiming the CTC isn’t complicated, especially if you file with TaxAct! We’ll walk you through the steps and help you claim the credit automatically. Just answer our simple interview questions about your dependents, income, and filing status.

Based on the information you provide, our tax preparation software will calculate your CTC and whether any amount is refundable (the ACTC). If all looks good, you’ll see a screen like the one below showing how much of each you qualify for:

Child Tax Credit FAQs

What happened to the advance monthly CTC payments?

The monthly advance CTC payments were a temporary measure brought about by the American Rescue Plan during the pandemic. Essentially, parents were allowed to claim part of the CTC in advance monthly payments instead of waiting until filing their tax return.

If you’re looking for monthly payments like in 2021, those aren’t happening right now — this was a temporary pandemic relief measure that has since expired. There are currently no advance Child Tax Credit payments scheduled 2025.

How many children can I claim the Child Tax Credit for?

There’s no official limit to how many children you can claim the CTC for, as long as each child meets the eligibility requirements.

Can I claim the CTC if I had a baby in 2024?

Yes! If your child was born at any time in 2024, they’re considered to have lived with you the entire year for tax purposes. So, for example, you’ll be able to claim any qualifying children born in 2024 on your 2024 tax return (the taxes due April 15, 2025).

Who claims the CTC when parents are divorced?

The CTC is simple enough for married couples filing a joint return, but what if you are unmarried or divorced?

Only one parent can claim the credit per child, per year. Usually, this is the parent the child lives with most of the year — called the custodial parent — unless otherwise agreed in a custody arrangement. If the child lives with both of you equally, the Internal Revenue Service considers the parent with the higher adjusted gross income (AGI) to be the custodial parent. You and your spouse can also take turns claiming the child(ren) if you wish.

For more info on this topic, head over to IRS Publication 504, Divorced or Separated Individuals on irs.gov.

Can I claim the CTC for adopted children?

If you’re an adoptive parent, good news! Your adopted child can also qualify for the Child Tax Credit as long as all of the following apply:

- The child meets the age and residency rules.

- You legally adopted them or are in the process of adopting (and they were placed with you during the tax year).

- The child has a valid Social Security number.

Tax Tip: You might also qualify for the Adoption Tax Credit, which is a separate tax break that helps offset adoption costs. We talk more about this, the Earned Income Tax Credit (EITC), and other credits for new parents in Bottles, Diapers, and 7 Tax Benefits: Life with a Newborn.

What’s the difference between the CTC and the Adoption Tax Credit?

While both credits benefit parents, they serve different purposes. The Child Tax Credit provides ongoing annual tax relief for families raising children, including adopted children. The Adoption Credit, on the other hand, helps cover the upfront costs of adoption, such as court fees, travel, and adoption agency expenses. You can claim both if you qualify, but they’re applied differently on your tax return.

Can I claim the CTC for a dependent who isn’t my child?

The Child Tax Credit is only available for qualifying children under the age of 17 who meet specific IRS requirements, including having a valid Social Security number (SSN). You cannot claim the CTC for other dependents, such as older children, elderly parents, or relatives living with you.

However, if your dependent is not a qualifying child or has an ITIN instead of a valid SSN, you may still qualify for the Credit for Other Dependents (ODC). The ODC is a nonrefundable credit worth up to $500 per qualifying person. While it won’t increase your refund like the CTC can, it can help reduce your tax liability.

What is the Child and Dependent Care Credit?

This is another tax credit that often gets confused with the Child Tax Credit, but it covers a different kind of expense. The Child and Dependent Care Credit helps you offset the cost of paying for childcare (or care for a disabled spouse or dependent) so you can work or look for work. It’s based on your actual care expenses and is separate from the Child Tax Credit, which is focused on reducing your tax bill just for having qualifying children.

The bottom line

The Child Tax Credit is a valuable tool for reducing your tax bill as a parent or guardian. But like most tax credits, the details matter. Knowing who qualifies, how much you can claim, and whether you might get a refund can make a big difference when it’s time to file.

And if you’re feeling overwhelmed? You’re not alone. TaxAct can help you figure out what you’re eligible for and walk you through claiming the Child Tax Credit on your individual income tax return.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

The post What is the Child Tax Credit (CTC)? appeared first on .

Read MoreBy: Meghen Ponder

Title: What is the Child Tax Credit (CTC)?

Sourced From: blog.taxact.com/what-is-the-child-tax-credit/

Published Date: Tue, 06 May 2025 17:27:14 +0000

----------------------