If you’re a small business owner considering the S corp route, IRS Form 2553 is the key to electing S corporation status for your business. But don’t worry — filling out this form doesn’t need to be a headache. We’re here to guide you through the process and help you file Form 2553 without the hassle. Let’s dive into the details of this form, why it matters, and how to make sure you get it right.

At a glance:

- Form 2553 allows small businesses to elect S corporation status and avoid double taxation.

- Your business must meet specific eligibility requirements to be an S corp.

- Form 2553 must be filed on time — typically within 75 days of the start of your tax year.

What is IRS Form 2553?

IRS Form 2553 is the tax form you must file if you want to elect S corporation status for your business. This form essentially tells the Internal Revenue Service (IRS) that you want your small business corporation to be taxed as an S corp (we’ll get into what this means below).

What is an S corporation?

An S corp is a special tax status that allows your business to bypass corporate income taxes and instead pass profits, losses, and deductions directly to you as the owner to be reported on your personal tax return. This can result in significant tax savings, especially for small businesses.

As far as business entities go, S corps are not one of the default tax classifications. That’s why Form 2553 exists, so you can tell the IRS you wish to be taxed as an S corp.

Tax advantages of an S corporation

- No double taxation: Unlike a C corporation, an S corp doesn’t pay federal taxes on its profits. Instead, income or losses are passed through to you, the owner, and reported on your personal income tax return.

- Self-employment tax savings: As an S corp, you may reduce your self-employment taxes by taking part of your income as distributions rather than a salary. These distributions are generally not subject to self-employment tax, unlike regular income from a C corp.

Why choose S corp status?

Choosing S corporation status can help you save on taxes and simplify your business tax filings. It allows you to avoid the double taxation of a C corporation while enjoying the protection of limited liability for your business.

Who needs to file Form 2553?

- Corporations: If you’re already a C corporation, you may file Form 2553 to elect S corporation status.

- Limited liability companies (LLCs): An LLC can also file Form 2553 to become taxed as an S corp.

Requirements to elect S corp status

Before your small business can elect S corporation status, it must meet a few basic IRS eligibility requirements. To qualify, your business must:

- Be a domestic corporation or other business entity.

- Have no more than 100 shareholders.

- Shareholders must be U.S. citizens, permanent residents, or resident aliens.

- Have only one class of stock — no multiple classes with different rights.

- Shareholders must be individuals, estates, or certain trusts (no corporations or partnerships).

- Not be an ineligible corporation (like an insurance company, certain financial institutions, or a domestic international sales corporation).

Form 2553 example

Here’s what Page 1 of IRS Form 2553 looks like:

Common mistakes to avoid:

- Missed deadlines: Ensure you file Form 2553 by the appropriate deadline — within two months and 15 days of the beginning of your tax year. If it’s a late election, make sure to provide a reasonable cause explanation.

- Incomplete information: Double-check that you’ve provided all the necessary details, such as your EIN, shareholder consent, and tax year.

Form 2553 instructions: How to file Form 2553

When filing Form 2553, it’s important to get it right. Here’s what to do for each part of the form.

Part I: Election information

This is the easiest part. Start by filling out some basic information about your business:

- Box A: Enter your business name, employer identification number (EIN), and mailing address. If your personal address is also your business mailing address, you can write [Business Name] C/O [Your Name] as the address.

- Box B: The date your business was incorporated or registered.

- Box C: The state where you formed your business.

- Box D: Check these boxes if you changed your business’s name or address after applying for your EIN.

Then, move on to your S corporation election information:

- Boxes E and F: Enter the date you want your S corp status to take effect and select your tax year. Consulting with a professional is a good idea if you want to choose an option other than a calendar year.

- Box G: Check this box only if you have over 100 shareholders, but some are family members. You can treat family members as a single shareholder.

- Box H: Enter contact info for your legal representative (this could also be you).

- Box I: This is where you can make the case for reasonable cause when filing a late election. If there isn’t enough room, feel free to attach a statement instead.

Once you sign and date the information above, you’ll go to page 2. This section asks for shareholder information:

- Box J: Enter the names and addresses of the shareholders who must consent to the S corp election.

- Box K: Each shareholder must sign and date the form under the consent statement.

- Box L: List the number of shares each shareholder owns (or the percentage of the company they own).

- Box M: Enter the Social Security number (SSN) for each shareholder (or EIN if the shareholder is a trust, estate, or exempt organization).

- Box N: Enter the date each shareholder’s tax year ends (typically Dec. 31).

Part II: Selection of Fiscal Tax Year

Only fiscal-year filers need to complete Part II for tax purposes. You can leave this section blank if you checked the calendar year in Part I.

It’s a good idea to have a tax professional help you fill out this section, but here is a quick summary of what it entails:

- Section O: Check the box that applies to your business.

- Section P: Select either natural business year or ownership tax year.

- Section Q: If you didn’t select anything in Section P, choose your business purpose tax year.

- Section R: If you didn’t select anything in Section P or Q, choose your backup fiscal year selection.

Part III: Qualified Subchapter S Trust (QSST) Election

This section won’t apply to many small businesses — it’s only for trusts that own S corp shares and pay all income to the income beneficiary. It asks for the beneficiary’s name, address, and SSN, plus the name and EIN of the trust.

Part IV: Late Corporate Classification Election Representation

You can skip this section if you file Form 2553 within the deadline. If you’re filing a late election, this part simply lists the eligibility requirements you must meet to qualify for late election relief.

Form 2553 FAQs

When is the deadline to file Form 2553?

The general deadline for filing Form 2553 is within two months and 15 days of the beginning of the tax year you want your S corporation status to be effective.

For example, if you want your LLC to be taxed as an S corp for 2025, you must file Form 2553 by March 15, 2025 (two months and 15 days after the tax year started on Jan. 1).

If you recently established your business entity, you must file Form 2553 within two months and 15 days of its formation date. Otherwise, you’ll receive the default tax status for the current tax year and must wait until the following tax year to be taxed as an S corp.

What happens if I miss the deadline?

If you miss the Form 2553 deadline, you may still qualify for S corporation status if you can provide evidence of reasonable cause for the late filing. However, it’s always best to file on time to avoid complications.

When filing a late election, you can either explain your reasonable cause on line I of Form 2553 or attach a statement with your form.

Can an LLC file Form 2553?

Yes, an LLC can file Form 2553 to elect S corporation status as long as it meets the eligibility requirements discussed earlier.

Where do I send Form 2553?

Unfortunately, you cannot e-file Form 2553; it has to be sent to the IRS by mail or fax. The address and fax number depend on where your business is located. For the most up-to-date information, check the IRS Where to File Your Taxes for Form 2553 page.

How long does it take for the IRS to process Form 2553?

Processing time can vary, but the IRS typically takes around 60 days to process your Form 2553. Be sure to file well in advance to avoid any unexpected delays. If you don’t hear back from the IRS within two months after filing Form 2553, follow up with the agency by calling 1-800-829-4933.

What’s the difference between Form 2553 and Form 8832?

Form 8832 is similar to Form 2553, as they are both used to change the tax classification for your business. However, Form 2553 is solely used for electing S corp status, while Form 8832 is used to elect other tax classifications.

Examples of situations where you’d file Form 8832 include:

- You want your LLC to be taxed as a C corporation.

- Your LLC is currently taxed as a C corp, and you want to return to its default tax treatment, such as a partnership or sole proprietorship.

How to file IRS Form 2553 with TaxAct

While you can’t e-file Form 2553 (it must be mailed or faxed to the IRS), TaxAct can still help you complete Form 2553 by guiding you through the process while you file taxes.

To enter or review information on Form 2553 in TaxAct:

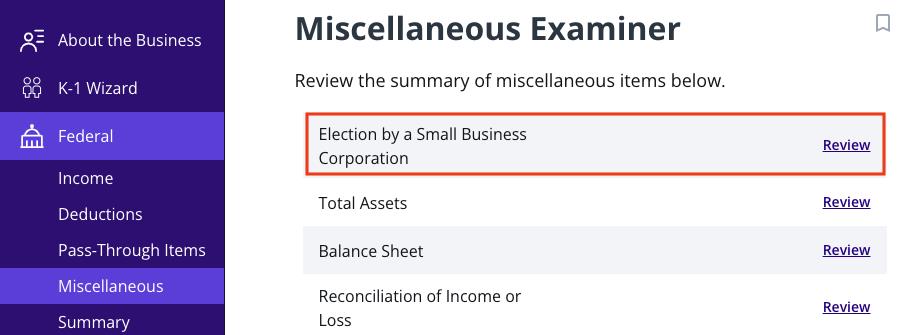

- From within your TaxAct Form 1120 or Form 1120-S return (Online or Desktop), click Federal. (On smaller devices, click the menu in the top left corner, then click Federal.)

- Click Miscellaneous, then select Election by a Small Business Corporation as shown below:

- Continue with the interview questions, and we’ll help you fill out Form 2553 step-by-step.

The bottom line

Filing Form 2553 is an essential step if you’re looking to take advantage of the tax benefits of being an S corporation. With TaxAct’s help, you can complete Form 2553 accurately and on time, without the stress. Ready? Let’s start filing.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

The post Your Guide to Filing Form 2553: Electing S Corporation Status for Your Business appeared first on .

Read MoreBy: Meghen Ponder

Title: Your Guide to Filing Form 2553: Electing S Corporation Status for Your Business

Sourced From: blog.taxact.com/guide-to-form-2553/

Published Date: Wed, 12 Feb 2025 21:34:33 +0000

----------------------