The tax treatment of research and development (R&D) expenses is one of the biggest issues facing Congress as the year winds down. Since the beginning of 2022, companies have had to spread deductions for R&D costs out over five years, instead of deducting them immediately. This policy, known as R&D amortization, reduces economic growth by penalizing investment generally, especially in R&D-intensive industries.

R&D investment is not spread evenly across the economy—it is concentrated heavily in a few sectors. Manufacturing accounts for most private sector R&D, at 58 percent, while the Information industry (composed largely of software and data processing) accounts for another 22.4 percent, and Professional, Scientific, and Technical Services accounts for 10.8 percent.

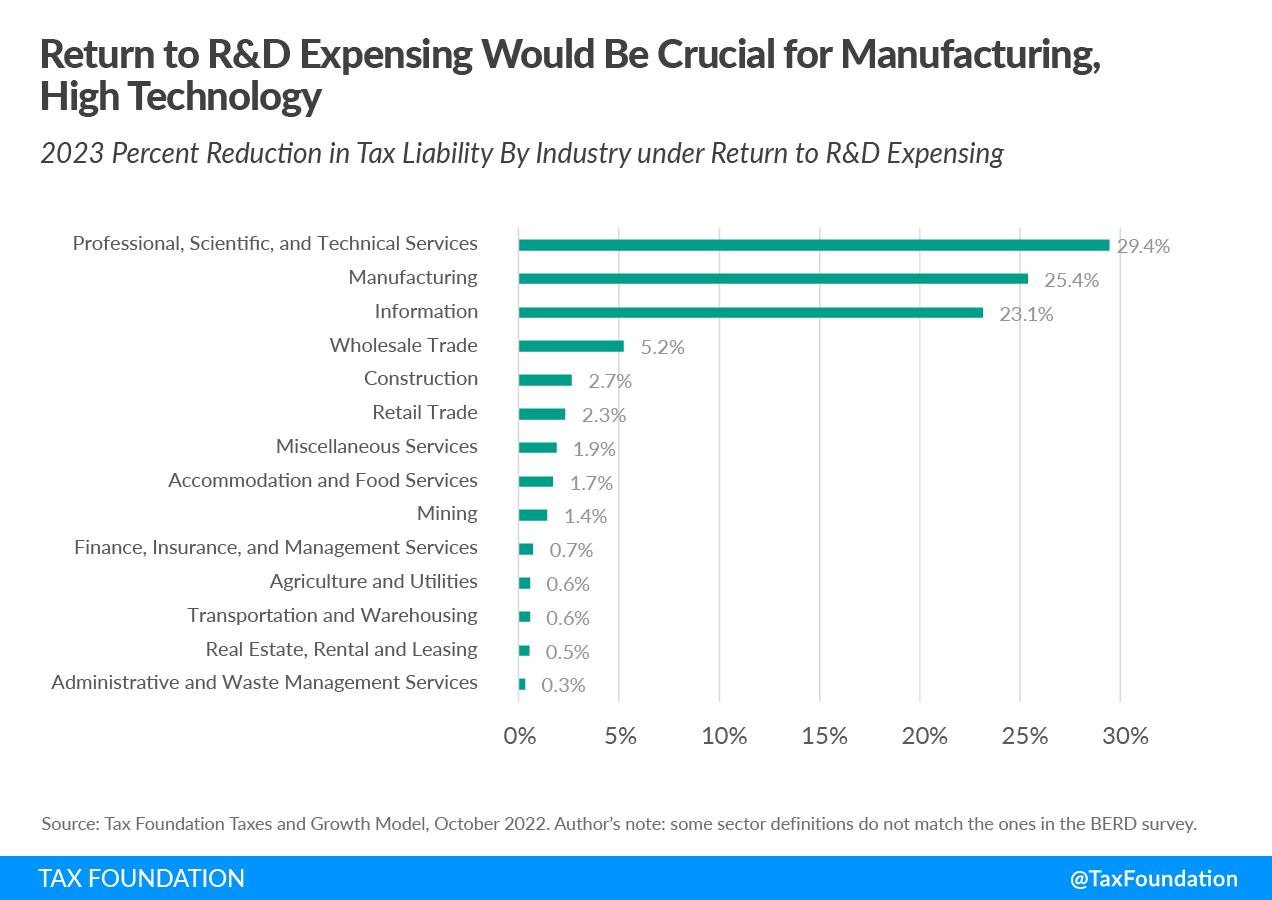

Correspondingly, these industries would see the largest benefits from returning to full expensing for R&D investment, according to Tax Foundation’s industry modeling.

All three industries would see a reduction in tax liability of over 20 percent in 2023. Meanwhile, Wholesale Trade would see the fourth-largest tax reduction, at just over 5 percent. Unsurprisingly, this modeling shows that these industries are the most negatively impacted by the existing policy of R&D amortization.

In dollar terms, manufacturing faces the largest tax increase as a result of R&D amortization, at $31.7 billion in 2023, followed by Information at $3.7 billion and Professional, Scientific, and Technical Services at $2.0 billion (see Table 2).

Industrial policy has become a major topic of debate in policy circles today. While many disagree over what constitutes industrial policy, it generally involves a strategic government effort to reallocate resources towards industries of interest, often in the manufacturing sector, as a strategy to improve long-run growth. At least in theory, those industries of interest are ones with high potential for productivity growth and technological development.

The industrial policy advocate might argue that certain high-tech industries should receive specific subsidies, due to their potential for new, innovation-enhancing technology. The CHIPS and Science Act, passed and signed into law this year, included one such policy, creating a tax credit for semiconductor manufacturers. The critic would argue that such subsidies are unneeded, reflect a handout to well-connected incumbent firms, and ultimately undermine that industry’s ability to stand on its own.

But no matter which side of the industrial policy debate you take, R&D amortization looks foolish. It is a targeted penalty on exactly the types of high-tech industries industrial policy advocates want to support. Meanwhile, from the perspective of the industrial policy critic, the policy violates neutrality across industries, as it punishes industries that rely on R&D investment over ones that do not. If anything, R&D amortization is an example of de-industrial policy: a government policy choice that distorts markets against manufacturing and technology.

Take semiconductors, for example. According to detailed industry-level data from the National Science Foundation, semiconductor and other electrical components manufacturers performed over $35 billion in domestic R&D in 2019, a staggering 7 percent of the total $492 billion domestic R&D businesses performed that year. Semiconductor industry R&D dwarfed the R&D spending of entire major sectors of the economy, including Finance and Insurance, Wholesale Trade, Retail Trade, and Transportation and Warehousing.

Therefore, forcing companies to amortize R&D costs, rather than deduct them immediately, disproportionately penalizes the R&D-intensive semiconductor industry, even though politicians of both parties have made government support for semiconductors a priority.

R&D amortization hurts investment broadly and punishes the very cutting-edge industries needed to maximize long-run economic growth.

| Sector | Domestic R&D Performed (2019), billions | Corresponding NAICS Codes |

|---|---|---|

| Manufacturing | $285.67 | 31–33 |

| Mining | $2.72 | 21 |

| Utilities | $0.28 | 22 |

| Wholesale Trade | $1.19 | 42 |

| Transportation and Warehousing | $9.89 | 48–49 |

| Information | $110.23 | 51 |

| Finance and Insurance | $8.92 | 52 |

| Real Estate, Rental, and Leasing | $1.37 | 53 |

| Professional, Scientific, and Technical Services | $53.23 | 54 |

| Health Care Services | $2.27 | 621–23 |

| All Other Sectors | $17.20 | 23, 44-45, 55-56, 624, 71-72, 81 |

| Total | $492.96 | |

| Source: National Center for Science and Engineering Statistics, “Business Enterprise Research and Development: 2019,” National Science Foundation, Apr. 28, 2022, https://ncses.nsf.gov/pubs/nsf22329. Author’s calculations. | ||

| 2023 Reduction in Tax Liability from Canceling R&D Amortization ($ Billions) | 2023 Percent Reduction in Tax Liability from Canceling R&D Amortization | Corresponding NAICS Codes | |

|---|---|---|---|

| Mining | $0.21 | 1.4% | 21 |

| Construction | $0.05 | 2.7% | 23 |

| Manufacturing | $31.69 | 25.4% | 31-33 |

| Wholesale Trade | $1.24 | 5.2% | 42 |

| Retail Trade | $0.94 | 2.3% | 44-45 |

| Transportation and Warehousing | $0.04 | 0.6% | 48-49 |

| Information | $3.67 | 23.1% | 51 |

| Finance, Insurance, and Management Services | $0.51 | 0.7% | 52, 55 |

| Real Estate, Rental and Leasing | $0.02 | 0.5% | 53 |

| Professional, Scientific, and Technical Services | $1.97 | 29.4% | 54 |

| Administrative and Waste Management Services | $0.01 | 0.3% | 56 |

| Accommodation and Food Services | $0.07 | 1.7% | 72 |

| Miscellaneous Services | $0.13 | 1.9% | 61, 62, 71, 81 |

| Agriculture and Utilities | $0.04 | 0.6% | 11, 22 |

| Source: Tax Foundation Taxes and Growth Model, October 2022. | |||

By: Kyle Hulehan

Title: Return to R&D Expensing Crucial for Manufacturing and Technology Investment

Sourced From: taxfoundation.org/rd-expensing-rd-amortization/

Published Date: Wed, 07 Dec 2022 14:55:15 +0000

----------------------