Updated for 2024.

Driving for Uber® or Lyft® can be a great way to earn extra income, but tax season can be confusing for new drivers. Since rideshare drivers are considered independent contractors, they don’t have taxes automatically withheld from their earnings. Instead, they must report their self-employment income and take advantage of tax deductions to reduce their taxable income and overall tax liability.

One of the best ways to lower your tax bill as a rideshare driver is by claiming every business expense you’re eligible for. In this guide, we’ll cover everything you need to know about Uber tax deductions, including mileage tracking, vehicle expenses, phone costs, and more.

At a glance:

- Uber and Lyft do not withhold taxes, so drivers must track and pay their own income and self-employment taxes.

- Tax deductions like the mileage deduction can significantly reduce taxable income for rideshare drivers.

- Keep detailed records of mileage, vehicle expenses, and business-related costs to maximize deductions and avoid IRS issues.

Understanding Uber and Lyft taxes

Do Uber and Lyft take out taxes?

No, Uber and Lyft do not withhold income tax or self-employment taxes from your earnings. As an independent contractor, you are responsible for setting aside money for Social Security and Medicare taxes (also known as self-employment tax) and making quarterly estimated tax payments to the IRS if necessary.

Who needs to pay estimated taxes?

Anyone who expects to owe at least $1,000 in taxes from self-employment income must make quarterly estimated tax payments to the IRS. This typically applies to full-time rideshare drivers and some part-time drivers who earn significant income.

However, if you also have a W-2 job where taxes are withheld, you may be able to adjust your withholdings to cover your rideshare earnings instead. You can do this by filling out a new Form W-4 and giving it to your employer.

Try using our Self-Employment Tax Calculator and Income Tax Calculator to estimate how much you will owe.

Tips for making quarterly tax payments

Don’t get overwhelmed by estimated tax payments — many rideshare drivers find them confusing at first, but with the right approach, they become easy enough to manage. A great way to stay on top of tax payments is to set aside a portion of each ride’s earnings for taxes in a separate bank account.

If you file your taxes with us, TaxAct can help you calculate and set up automatic estimated tax payments. For more details on this topic, check out our guide, How to Calculate and Make Estimated Tax Payments.

Which Lyft and Uber tax forms do rideshare drivers receive?

As a rideshare driver, you’ll likely receive Form 1099-K, which reports the income you earned from rides during the tax year. You may also receive Form 1099-NEC if you earned at least $600 in non-driving income.

- Form 1099-K is provided if a driver processes over $5,000 in gross trip earnings in 2024 (though state-specific thresholds may vary). For tax year 2025, the 1099-K reporting threshold will drop to $600.

- Form 1099-NEC is issued when drivers earn at least $600 in non-driving earnings, such as referrals, on-trip promotions, or other incentives and bonuses. Until 2020, this information was reported on Form 1099-MISC.

- Drivers may also get a tax summary from the rideshare service detailing their ride payments, non-ride earnings, and business-related expenses such as fees, tolls, etc. This document is not required, but both Uber and Lyft have provided these to drivers to make tax filing easier.

All these tax documents should be available to you by Jan. 31.

Note: Even if you do not receive a Lyft or Uber Form 1099, you still need to report all rideshare income on your tax return. This is why keeping your own records is so important!

Top tax deductions for rideshare drivers

1. Mileage deduction: The biggest Lyft or Uber tax deduction

As a rideshare driver, your most significant tax deduction is typically the mileage deduction. The IRS allows you to deduct miles driven for business use, which includes:

- Driving to pick up a passenger

- Transporting a passenger to their destination

- Driving between fares

There are two methods you can use for deducting mileage:

- Standard mileage deduction: This method allows you to deduct a set rate per mile driven for business. For 2024, the IRS standard mileage rate is $0.67 per mile, and for 2025, the rate is $0.70 per mile (check the IRS website for updates). If you choose this method, you cannot deduct the actual costs of operating your vehicle.

- Actual expenses method: Instead of deducting a standard amount per mile, you can deduct the actual car expenses associated with your rideshare business, such as gas costs, vehicle repairs and maintenance, etc. This requires more detailed recordkeeping but could potentially lead to a bigger deduction, depending on your situation.

The IRS requires detailed records of all business miles, so it’s essential to keep an accurate mileage log or use a mileage tracking app (examples include MileIQ® and Everlance®) to keep track of your business-related driving.

While Uber and Lyft track some of your mileage, it’s usually best not to rely solely on their data, as this could lead to underreporting your miles. Always track your own miles to ensure you’re maximizing your tax deduction.

If you plan on using the standard mileage deduction, our Mileage Reimbursement Calculator can help you estimate your tax deduction.

2. Vehicle expenses

If you opt for the actual expenses method instead of the standard mileage deduction, you can deduct a portion of the costs related to your rideshare vehicle. Eligible vehicle expenses include:

- Gas

- Car registration fees

- Oil changes

- Routine maintenance and repairs

- Car insurance

- Car washes or detailing

- Vehicle depreciation (only if your business use of the car is greater than 50%)

- Lease payments or car payments

To claim these tax write-offs, you’ll need to calculate the percentage of your car’s use for business-related purposes and keep detailed records of all expenses. The percentage you can deduct is based on the miles you drive. If you only use your car for business purposes, your vehicle expenses are 100% deductible.

For example, if you drive 20,000 miles in a year and 15,000 of those miles are for Uber or Lyft, then 75% of your car expenses can be deducted. If your total car expenses for the year are $5,000, you could deduct $3,750 ($5,000 x 75%).

3. Car loan interest

If you financed your vehicle, you can deduct the interest paid on your car loan, even if you use the standard mileage deduction instead of the actual expenses method. Again, the deductible portion is based on the percentage of your vehicle’s use for rideshare driving. Note that your entire car payment isn’t deductible — just the portion that went toward your car loan interest.

For example, if 75% of your total miles driven are for Uber or Lyft, then 75% of your car loan interest may be deductible. So, if you paid $1,000 in loan interest, your deduction would be $750.

3. Tolls and fees

You can also deduct any tolls and parking fees paid while actively driving for Uber or Lyft. However, you cannot deduct:

- Tolls or parking fees paid during personal trips

- Parking tickets or traffic fines

4. Cell phone expenses

Since your mobile phone is an essential tool for rideshare driving, you can deduct:

- A percentage of your phone bill (proportional to business use)

- The cost of your mobile phone (if purchased solely for business use)

- Cell phone accessories used for business purposes, like chargers and mounts

You can only write off 100% of phone expenses as a tax deduction if you have a separate business phone line that you use exclusively for rideshare services. If you also use your phone for personal use, it’s best to keep a log of your work hours to help you determine how often you use your phone for business purposes. This way, you have some proof to show the IRS if needed.

For example, if you use your phone 50% of the time for your rideshare business, you can deduct 50% of your phone bill. You would not be able to deduct phone payments if you financed your cell phone unless you used it exclusively for your rideshare business.

5. Rideshare-related subscriptions & fees

No matter which rideshare service you work with, they all take a percentage of your earnings. While you can’t stop Uber or Lyft from taking their cut, you don’t have to pay taxes on money you didn’t actually receive. You can deduct the fees and commissions charged by the rideshare platform as business expenses.

Deductible fees can include:

- Uber and Lyft commissions

- Booking fees

- Tolls paid through the app

- Referral fees

- Mileage tracking app subscriptions

The 1099 tax form(s) you get in the mail from the rideshare service should list any fees and commissions they took from your earnings. If you opt for paperless tax documents, you can also view these figures via your online account or driver dashboard.

6. Passenger amenities and safety

Providing a comfortable and safe ride experience can lead to better ratings (and more tips!). Expenses related to passenger comfort and safety are deductible, including:

- Music streaming subscriptions (if used for passenger enjoyment)

- Extra phone chargers for guests to use

- Bottled water and snacks for passengers

- Seat covers or cleaning supplies to maintain a tidy vehicle

- First aid kits

- Jumper cables

- Roadside assistance plans

These costs qualify as business expenses as long as they are used for your rideshare work.

7. Health insurance premiums

If you are a self-employed rideshare driver, you may be able to deduct your health insurance premiums, including coverage for yourself, your spouse, and dependents. However, this deduction has some limitations:

- If rideshare driving is your primary job, you can deduct the full cost of your health insurance premiums as an adjustment to income on your tax return.

- If you have another job offering health insurance but choose to purchase your own plan, you may not be eligible for this deduction.

- The deduction applies only to months when you were not eligible for an employer-sponsored health plan.

Make sure to keep records of your health insurance payments and consult a tax professional if you are unsure about eligibility.

FAQs about Uber and Lyft taxes

Do Uber drivers get tax refunds?

Yes, if your tax deductions reduce your taxable income enough, you may be eligible for a tax refund. However, since Uber and Lyft do not withhold taxes, many drivers end up owing money instead. It all depends on whether you overpaid or underpaid your federal income taxes.

What if I forgot to track my miles?

You can estimate your business miles using Uber or Lyft trip history, but the IRS prefers detailed records. It’s best not to rely solely on rideshare trip history when claiming the mileage deduction. Consider using a mileage tracking app next tax year so you’re not missing out on a bigger deduction!

Can I deduct my car payment?

You can only deduct your car payment if you use the actual expenses method for your mileage deduction. In that case, you can deduct the portion of your lease or loan payment used for your rideshare business based on the business miles you drove.

However, you can always deduct car loan interest payments (proportional to business use) even if you claim the standard mileage deduction.

Are car insurance and registration fees deductible?

Yes, if you use the actual expenses method, you can deduct car insurance and registration fees. However, you can only deduct the portion related to business use.

What about DoorDash tax deductions?

Uber Eats®, DoorDash®, Instacart®, and other delivery drivers face similar tax rules and deductions as rideshare drivers. If you deliver food instead of passengers, you can still deduct mileage, certain vehicle expenses, and service fees mentioned in this article.

How can I lower my tax bill as a rideshare driver?

To lower your tax bill, you’ll want to maximize your tax deductions, keep detailed records, and calculate if you need to make quarterly estimated tax payments to avoid underpayment penalties.

How to file taxes as an Uber or Lyft driver

Step 1: Gather your tax documents.

Before you file, collect all the following that apply:

- Form 1099-K

- Form 1099-NEC

- Your rideshare tax summary

- Mileage log

- Receipts for all business-related expenses you intend to claim (tolls, parking, phone costs, vehicle costs, etc.)

Your 1099 form(s) and tax summary from the rideshare service should be available by Jan. 31 for taxes typically due April 15.

Step 2: Report your income and deductions on Schedule C.

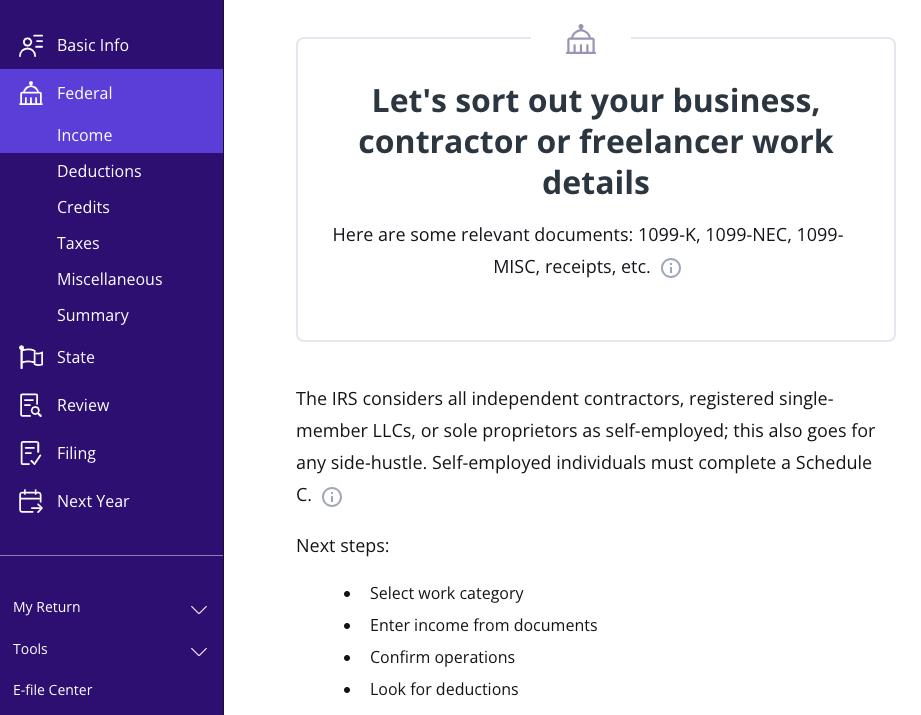

TaxAct makes it easy to report your rideshare income. Here’s how to get started.

First, you’ll need to select TaxAct Self-Employed.

After entering your basic information, we’ll help you enter your business income and expenses using Schedule C. To enter the applicable Schedule C information:

- From within your TaxAct return (Online or Desktop), click Federal (on smaller devices, click in the top left corner of your screen, then click Federal).

- Click Form 1099-NEC as shown below (even if you received a 1099-K).

- This will take you to the following page, where you’ll be able to enter your rideshare driver tax forms:

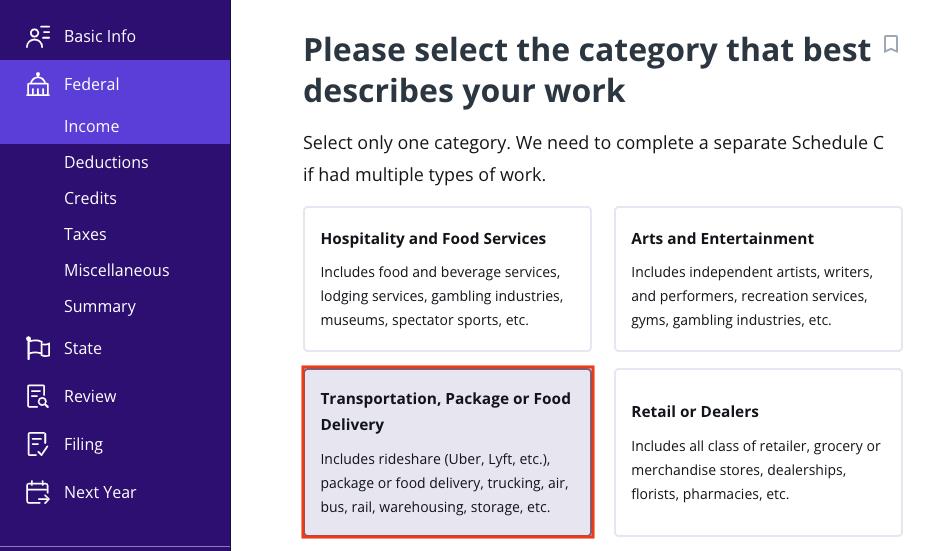

- To get started, select Transportation, Package or Food Delivery, as shown below, to indicate that you worked for a rideshare service.

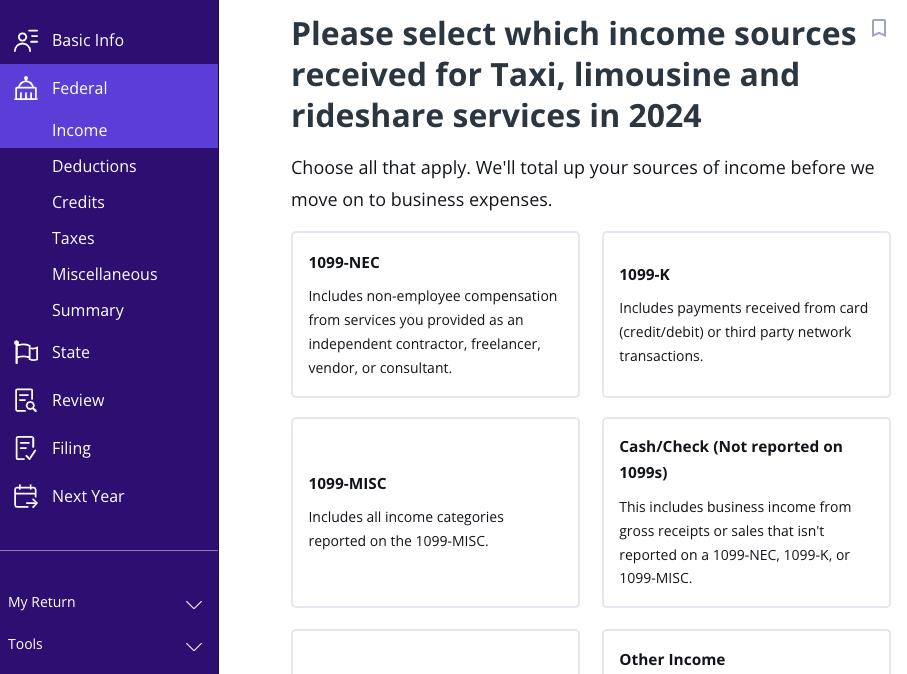

- You’ll then be able to select which tax forms you received from the rideshare service. Make sure to select all that apply.

- Continue filling out your income and tax deduction information as prompted by our step-by-step tax software.

Step 3: File your tax return.

Once you’ve entered all your information and verified everything for accuracy, TaxAct will submit your tax return to the IRS. That was easy!

The bottom line

Being a rideshare driver means you’re responsible for paying your own income taxes, but various tax deductions can help reduce your tax liability. By keeping detailed records and tracking all your business expenses, you can significantly lower your bill come tax time.

When tax season arrives, consider using TaxAct to simplify your self-employed tax preparation. Our tax preparation software can help you pay estimated taxes, claim tax deductions, and streamline the filing process. Plus, with TaxAct Self-Employed, you can file with confidence backed by a $100k Accuracy Guarantee.*

*Guarantee limited to $100,000 to pay legal or audit costs and the difference in lower refund or higher tax liability. Additional terms and limitations apply. Read about the TaxAct Maximum Refund and $100k Accuracy Guarantees.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

All trademarks not owned by TaxAct, Inc. that appear on this website are the property of their respective owners, who are not affiliated with, connected to, or sponsored by or of TaxAct, Inc.

The post Maximizing Your Tax Deductions as an Uber or Lyft Driver appeared first on .

Read MoreBy: Meghen Ponder

Title: Maximizing Your Tax Deductions as an Uber or Lyft Driver

Sourced From: blog.taxact.com/tax-deductions-for-uber-and-lyft-drivers/

Published Date: Tue, 18 Mar 2025 20:28:00 +0000

----------------------