If you purchased health insurance coverage through the Health Insurance Marketplace, you might need to file IRS Form 8962 with your federal income tax return. This form helps determine if you’re eligible for the Premium Tax Credit (PTC) and whether you need to repay any excess credit or claim additional credit as a tax refund.

Don’t worry — we’re here to help you understand this important document and file Form 8962 without the hassle when you’re ready. Here’s what you need to know.

At a glance:

- Form 8962 helps reconcile your Premium Tax Credit (PTC) with any Advance Premium Tax Credit (APTC) received.

- If you got too much APTC, you may need to repay excess APTC. If you qualify for additional PTC, it can increase your tax refund.

- TaxAct simplifies filing Form 8962 to ensure you claim the right health insurance tax credits.

What is IRS Form 8962?

Form 8962 helps you determine if you received the right amount of Premium Tax Credit (PTC) for your Marketplace health insurance coverage in a qualified health plan. If you received Advance Premium Tax Credit (APTC) payments to help lower your monthly premiums, this form makes sure you’re reconciling tax credits correctly when you file your federal income tax return.

In plain talk, it helps the Internal Revenue Service (IRS) determine whether you received the right credit amount based on your household income and other factors. You might have to repay some of the credit if you received too much. If you didn’t receive enough, you may get a bigger tax refund.

What is the premium tax credit?

The PTC is a tax credit designed to help eligible individuals and families afford health insurance coverage purchased through the Health Insurance Marketplace. The amount of PTC you qualify for depends on your household income, tax family size, and the cost of your area’s Second Lowest Cost Silver Plan (SLCSP).

You can also choose to take advance payment of Premium Tax Credit (APTC). Marketplace may also refer to these payments as a subsidy. The APTC is a portion of the PTC paid directly to your health insurance provider throughout the year, reducing your monthly premium costs. Basically, you receive the tax credit in advance throughout the year instead of waiting to claim the full credit when you file your tax return.

However, the APTC is based on estimated household income, meaning you must reconcile it when you file your tax return using Form 8962. If your actual income is higher than you estimated, you may need to repay excess advance PTC payments. If it is lower, you may be eligible for additional PTC, which could increase your tax refund.

PTC eligibility requirements

- You were enrolled in health insurance coverage through the Marketplace for at least one month of the calendar year.

- You did not qualify for an employer-sponsored plan considered affordable for your income level.

- You were not eligible to enroll in a government program such as Medicare, Medicaid, or CHIP.

- You fall within certain household income limits.

- No one else can claim you as a dependent on their tax return.

- Your filing status is not married filing separately.

- Note: There are exceptions for some victims of domestic abuse and spousal abandonment — the IRS addresses these scenarios on its PTC FAQ page.

Common terms explained

- Premium Tax Credit (PTC): A tax credit that helps lower health insurance premiums for eligible taxpayers.

- Advance Premium Tax Credit (APTC): Portions of the PTC paid in advance to help cover health insurance plan costs throughout the year.

- Second Lowest Cost Silver Plan (SLCSP): The benchmark plan used to calculate your PTC amount, based on plans available in your Marketplace coverage area.

- Federal poverty line (FPL): A measure of income used to determine eligibility criteria for specific programs and benefits, including the PTC. See the FPL chart on healthcare.gov.

- Household income: The total income for all family members on your tax return, used to determine your PTC eligibility.

Why is tax Form 8962 important?

Form 8962 ensures that taxpayers receive the correct amount of PTC and account for any differences between their estimated and actual household income for the year. If your household income was higher than you estimated, you might have to repay excess APTC. But if you earned less than expected, you could qualify for extra PTC, which could mean a higher tax refund. Either way, Form 8962 helps ensure you get the right amount of tax credits for health insurance and stay in line with IRS rules.

In short, filing Form 8962 ensures you:

- Reconcile advance payments of the Premium Tax Credit (APTC).

- Claim the correct amount of PTC if you’re eligible for additional credit.

- Stay compliant with IRS tax filing requirements related to the Affordable Care Act.

Who needs to file Form 8962?

You must use Form 8962 if:

- You purchased health insurance through the Health Insurance Marketplace.

- You or a family member in your tax household received the APTC.

- You want to claim the Premium Tax Credit (PTC) when you didn’t receive an advance payment.

You won’t need this form if you didn’t get insurance through the Marketplace.

Form 8962 example

IRS Form 8962 (page 1) looks like this:

Example scenarios: Reconciling the PTC

- Underestimated income: When applying for Marketplace coverage,John underestimated his household income by $10,000. Based on his estimate, his family received $2,400 in APTC ($200 per month). However, with his actual income, he was only eligible for $1,200 in PTC. When he files his federal income tax return, he must repay the excess APTC of $1,200, which will reduce his tax refund or increase the amount he owes, depending on his tax situation.

- Overestimated income: Due to a job loss, Sarah overestimated her household income by $15,000 during health coverage enrollment. She was initially granted only $800 in APTC for the year ($67 per month), but with her actual income, she qualifies for $2,000 in PTC. Since she received too little APTC, she can claim an additional $1,200 as a tax refund when she files Form 8962 with her federal income tax return.

Form 8962 instructions: How to fill out Form 8962

To fill out Form 8962, you need Form 1095-A (Health Insurance Marketplace Statement), which provides details about your insurance coverage.

Here’s a step-by-step guide for when you’re ready to file. (Or, if you want to make things easy, just let our tax preparation software walk you through the Form 8962 filing process.)

Part I: Annual and Monthly Contribution Amounts

First, write your name and Social Security number (SSN) at the top of the form.

- Enter your household income, tax family size, and modified adjusted gross income (MAGI) from your Form 1040.

- Calculate your household income as a percentage of the federal poverty line (FPL) using the IRS instructions.

- Determine the annual and monthly contribution amounts you’re expected to pay toward your health insurance premiums.

Part II: Premium Tax Credit Claim and Reconciliation of Advance Premium Tax Credit

This section helps you calculate the PTC you qualify for and compare it against any APTC you received.

- If you had Marketplace coverage for the whole year, enter your annual totals on Line 11.

- If your coverage changed throughout the year, use the monthly breakdown provided.

- By the end of Part II, you’ll determine three key amounts:

- Line 24: Your total PTC.

- Line 25: The APTC you received.

- Line 26: Your net PTC. If Line 24 is greater than Line 25, you get a tax credit; if Line 25 is greater, leave this line blank and continue to Part III. If the amounts are equal, enter zero and stop there.

Part III: Repayment of Excess APTC

If you received more APTC than you were eligible for, you might need to repay excess APTC. This is where Part III comes in.

- Line 27: Subtract Line 24 from Line 25 to find any excess APTC.

- Line 28: Enter the repayment limitation (check Table 5 in the irs.gov instructions to see if a repayment cap applies based on income).

- Line 29: Enter the smaller of Line 27 or Line 28 — this is the amount you need to repay on your Form 1040.

Part IV: Shared Policy Allocations

If you shared a health insurance policy with someone outside your tax family (e.g., you got a divorce during the tax year), you may need to allocate the Premium Tax Credit between tax filers. This section allows you to split policy amounts fairly based on agreed percentages. You’ll need to consult with the other tax family to determine how you will split reconciling any APTC repayments if needed.

Part V: Alternative Calculation for Marriage

This section is only for those who got married during the tax year. It determines whether you can use the alternative calculation for the year of marriage to reduce your excess APTC repayment.

- Use Table 4 in the instructions for Form 8962 to check if you qualify.

- If eligible, this calculation may help lower your repayment amount.

Form 8962 FAQs

How does Form 1095-A relate to Form 8962?

To complete Form 8962, you’ll need information from Form 1095-A, Health Insurance Marketplace Statement. Form 1095-A provides details about your health insurance premiums, monthly premium amounts, and the Second Lowest Cost Silver Plan (SLCSP), which are needed to calculate your PTC.

What happens if my income changes during the year?

If your household income changes, your APTC might need to be adjusted. Always report changes to the Marketplace ASAP to avoid an unexpected repayment during tax filing.

What if I didn’t receive Form 1095-A?

If you haven’t received Form 1095-A by mid-February, contact healthcare.gov or your state’s Marketplace to get a copy before filing your tax return.

Do I need to repay the APTC if I received too much?

Yes, if your household income exceeds the federal poverty line for taxes, you may have to repay excess APTC. However, if you made more than you expected but your income is still below 400% of the FPL, there is a repayment limitation on the amount you must repay.

What if I underestimated my income?

If your income was more than you estimated when applying for coverage, you would need to repay excess APTC in full if your income is above 400% of the federal poverty level. Repayment caps apply for household incomes below 400% of the FDP.

Can I claim the Premium Tax Credit if I didn’t receive an APTC?

Yes, if you meet the eligibility criteria, you can claim the PTC when you file your tax return. You’ll need to file Form 8962 to claim a Premium Tax Credit for any tax year in which no APTC was paid on your behalf.

What if I live in Alaska or Hawaii?

The PTC begins phasing out for those earning 100% to 400% of the federal poverty line. However, the income limits are higher if you live in Hawaii or Alaska. You can reference the poverty guidelines for all family sizes and income ranges, including different figures for Hawaii and Alaska residents.

How to file Form 8962 with TaxAct

TaxAct can help you easily file Form 8962 when you e-file with us. To get started, grab your Form 1095-A and follow these steps to input your information:

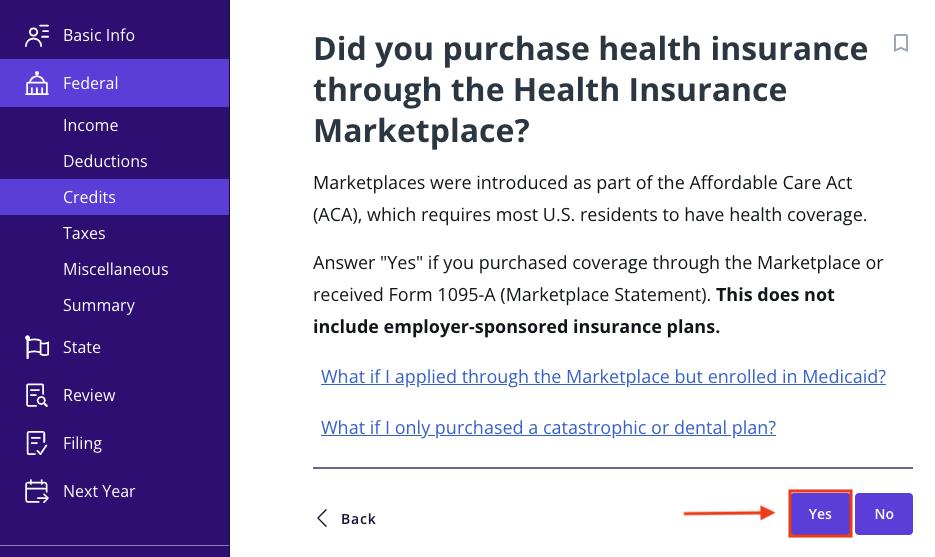

- From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

- Click Health Insurance as shown below.

3. Click Yes, as shown below, and then click Continue.

4. Continue with the interview process to enter your information. TaxAct will use your answers to fill out Form 8962 for you.

The bottom line

Filing Form 8962 ensures you’re correctly reconciling tax credits for your health insurance premiums. Whether you need to repay excess APTC or claim additional Premium Tax Credit, TaxAct can help you file with confidence.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

The post Form 8962: A Guide to the Premium Tax Credit appeared first on .

Read MoreBy: Meghen Ponder

Title: Form 8962: A Guide to the Premium Tax Credit

Sourced From: blog.taxact.com/guide-to-tax-form-8962-premium-tax-credit/

Published Date: Wed, 12 Feb 2025 21:00:47 +0000

----------------------