If you sold a life insurance policy this year, you may receive Form 1099-SB. This tax form informs you and the Internal Revenue Service (IRS) about the sale or transfer of a life insurance contract. But what does this mean for your taxes? Let’s walk through what the 1099-SB form is, why you received it, and how to handle it on your tax return.

At a glance:

- When you sell a life insurance policy, the issuer sends you Form 1099-SB, which reports your basis in the contract.

- You’ll also receive Form 1099-LS, which reports how much the buyer paid for the policy.

- These two forms can help determine if you owe any income tax on the policy sale.

- You will not owe taxes if you sold the policy for less than your basis.

What is a 1099-SB form?

Form 1099-SB, Seller’s Investment in Life Insurance Contract, reports how much you paid into a life insurance policy. When you sell or transfer your life insurance policy to a third party, it’s called a reportable policy sale, and the IRS requires the issuer of the life insurance contract to send you Form 1099-SB.

What is the purpose of a 1099-SB?

Selling a life insurance policy can be a taxable event, but only if you sold it for more than your cost basis. That’s what Form 1099-SB is for — it tells you the cost basis of your life insurance policy.

Receiving Form 1099-SB does not automatically mean you owe taxes on the life insurance sale. It’s simply an informational form that tells you and the IRS how much you’ve paid in policy premiums. You don’t need to report Form 1099-SB on your tax return, but you can use it in conjunction with Form 1099-LS, which reports how much you sold your policy for, to determine if you have taxable income to report.

IRS Form 1099-SB example

Here’s what this form looks like and a breakdown of the key sections:

On the left:

- The contact information for the policy issuer, including their taxpayer identification number (TIN).

- The seller’s information (you), including your policy number and TIN, which is often your Social Security number.

On the right:

- Box 1: Investment in contract – This is the total premiums you’ve paid toward the life insurance policy, excluding any dividends or earnings you may have received. This number serves as your basis for determining any taxable gains.

- Box 2: Surrender amount – This is the amount you would have received from the issuer if you surrendered the policy (canceled it) instead of selling it. This number only comes into play if you sold your policy for more than your basis. Remember, the acquirer (the party who bought the policy) should also send you Form 1099-LS, showing how much they paid you for the contract.

Form 1099-SB instructions

Not sure what to do with Form 1099-SB now that you have it? Follow these steps:

- Check for accuracy: Verify the details, like the policy number, payer information, and amount in Box 1. If anything seems off, contact the issuer right away.

- Look for Form 1099-LS: If you sold your life insurance policy, the buyer must send you Form 1099-LS, which shows how much they paid for the policy.

- Determine taxable income: If the amount in 1099-LS Box 1 is greater than the amount in 1099-SB Box 1, you may owe taxes on the excess amount (more on that below).

- E-file your tax return: If you have taxable income to report from the policy sale, TaxAct® can help you navigate this step without hassle — just make sure you have your tax forms handy to answer our interview questions.

FAQs about Form 1099-SB

What’s the difference between surrendering a life insurance policy and selling it?

Surrendering and selling are two ways to cash out your life insurance policy. Surrendering essentially cancels the policy, while selling transfers it to another third party:

- When you surrender your life insurance policy, you’re canceling it and getting whatever cash surrender value you’ve built up. The policyholder (you) receives a lump sum, but it’s typically less than the full value of the policy since you’re forfeiting future coverage.

- When you sell your policy in a reportable life insurance sale, you transfer ownership of the policy to a third-party acquirer in exchange for a lump sum (typically more than the surrender amount). The buyer takes over paying the premiums, and they will receive the death benefits when you pass away.

Both scenarios only result in a taxable event if your cash-out payment exceeds your basis in the policy (Box 1 of Form 1099-SB).

Where do I report 1099-SB on Form 1040?

You don’t need to report the 1099-SB form directly on your federal tax return (Form 1040). Instead, you’ll use it to figure out if you owe taxes on the sale of the life insurance policy. If you sold the policy for more than your basis (Box 1), any excess up to the cash surrender value (Box 2) gets reported as “Other Income” on Form 1040. Any additional excess greater than the cash surrender value is reported on Schedule D as a capital gain. TaxAct can help you with both scenarios (see the instructions in the next section).

When is the due date for issuers to send Form 1099-SB?

IRS reporting requirements for Form 1099-SB require the issuer of a life insurance contract to send the form to filers by Jan. 31, so expect to see it in your mailbox or inbox by mid-February.

What happens if I don’t get a 1099-SB form?

If you sold or transferred a life insurance policy but didn’t receive a 1099-SB form, contact the policy issuer to request it — you’ll need the form to report any taxable income from the sale.

Still have questions about Form 1099-SB? Check out the official IRS instructions for this form at irs.gov.

How to report Form 1099-SB with TaxAct

While you don’t need to file Form 1099-SB specifically on your tax return, you can use it alongside Form 1099-LS to determine if you have any taxable income to report. If you do, here’s how to report it in TaxAct. (If these steps look familiar, you might have seen them before in our Form 1099-LS article.)

To report ordinary income:

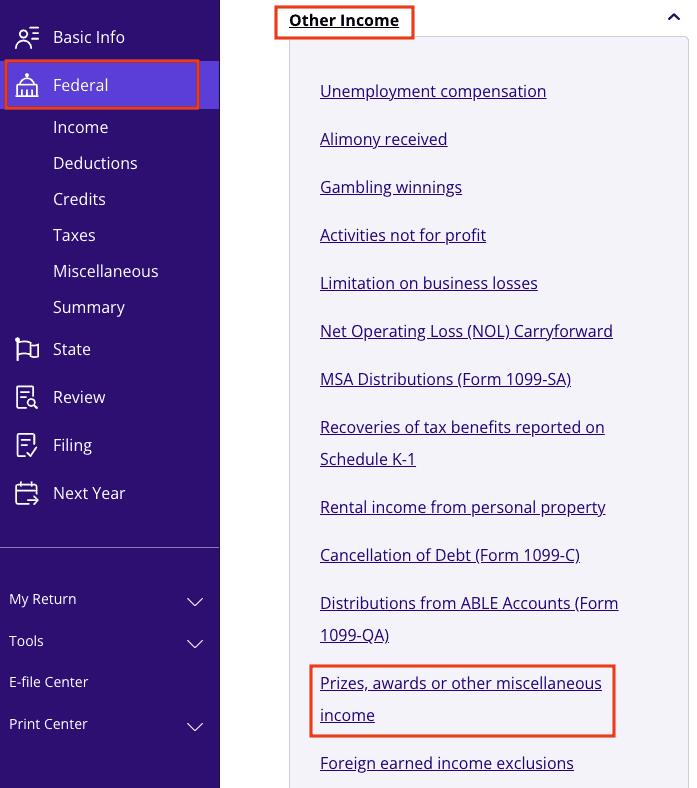

- Click Federal in the left navigation.

- On the Federal Quick Q&A Topics screen, click Other Income to expand the category.

- Click Prizes, awards or other miscellaneous income as shown below.

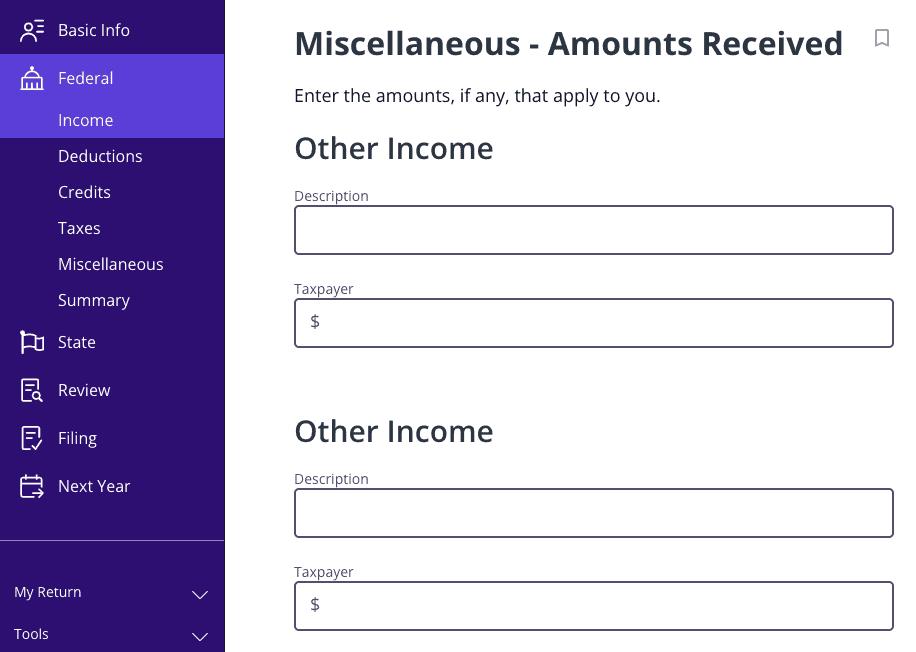

- Enter the amount and description in one of the two Other Income lines as shown below.

To report capital gains:

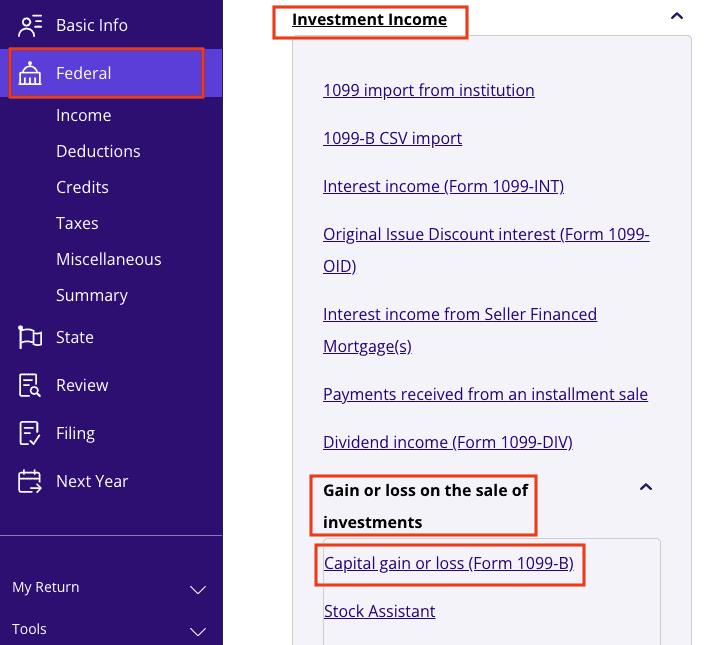

- Click Federal in the left navigation.

- On the Federal Quick Q&A Topics screen, click Investment Income to expand the category.

- Click Gain or loss on the sale of investments to expand the category.

- Click Capital gain or loss (Form 1099-B) as shown below.

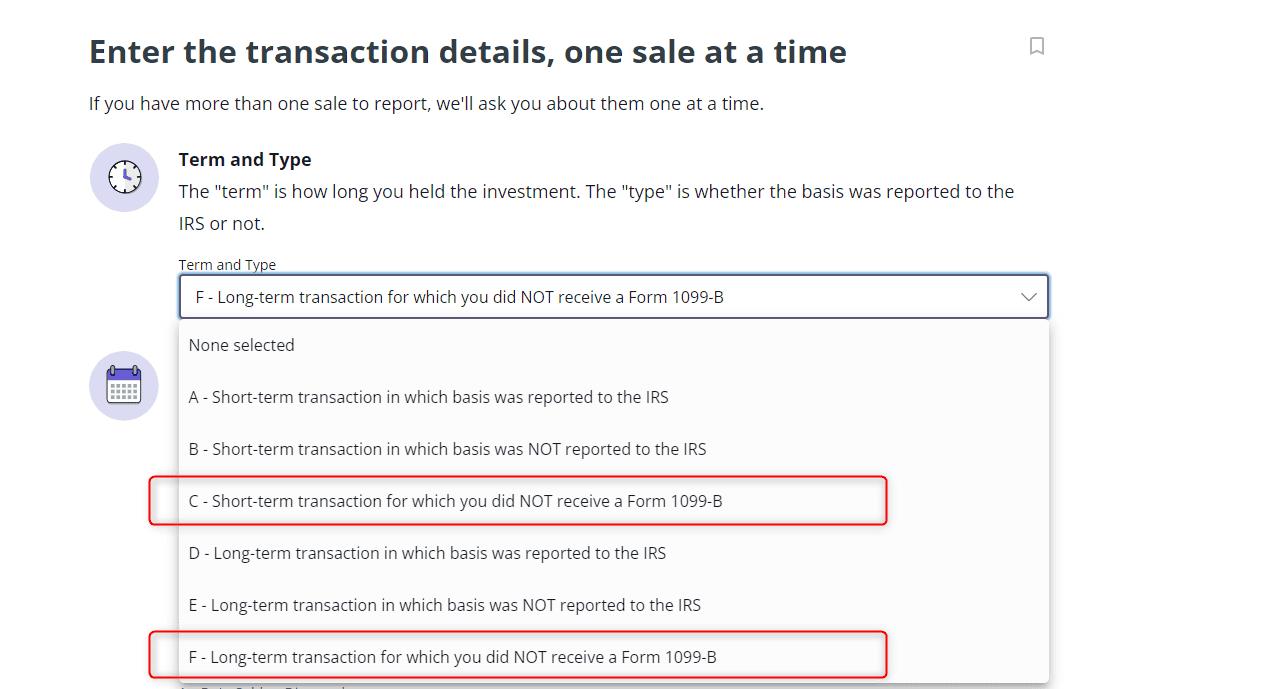

- Proceed with entering the transaction details. Under Term and Type, you’ll be able to select whether it was a short-term gain (you had the policy for a year or less) or long-term gain (you had the policy for over a year) for which you did not receive a Form 1099-B, as shown below:

The bottom line

Selling a life insurance policy sometimes comes with tax implications, but receiving a 1099-SB form doesn’t have to be stressful. Remember, Form 1099-SB simply informs you (and the IRS) about the sale of your life insurance contract. Use it alongside Form 1099-LS to determine if you owe income tax, then e-file with TaxAct for step-by-step tax filing assistance. We can help you take out the guesswork and file with confidence this tax year.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

The post Form 1099-SB: What It Is and How to Use It appeared first on TaxAct Blog.

Read MoreBy: Meghen Ponder

Title: Form 1099-SB: What It Is and How to Use It

Sourced From: blog.taxact.com/guide-to-1099-sb-form/

Published Date: Mon, 25 Nov 2024 17:15:40 +0000

----------------------