So, you’ve received a Form 1099-DIV in the mail, and you’re wondering what to do with it. Don’t worry — this tax form is not as intimidating as it might seem. The Internal Revenue Service (IRS) sends taxpayers Form 1099-DIV for informational purposes. Like other 1099 forms, it’s a reminder that you’ve earned income other than your typical salary during the tax year.

In this guide, we’ll break down everything you need to know about IRS Form 1099-DIV. Let’s dive right in.

At a glance:

- Form 1099-DIV reports dividends or distributions over $10 from investments like stocks or mutual funds.

- Dividends are taxable income that you must report on your tax return.

What is a 1099-DIV?

IRS Form 1099-DIV, officially titled Dividends and Distributions, is the form your financial institution sends you if you’ve earned more than $10 in dividends or other distributions from investments like stocks, mutual funds, or ETFs. It’s a form that tells you (and the IRS) how much money you made from those investments.

Why did I receive Form 1099-DIV?

Uncle Sam wants to know about the income you’ve earned outside of your regular paycheck. When you receive dividend distributions — essentially a share of a company’s profits distributed to shareholders — the IRS considers that taxable income, which needs to be reported on your tax return.

Example of Form 1099-DIV

Here is an example of what Form 1099-DIV looks like and the information that’s included on the tax form:

In addition to the payer’s information and tax identification number, here’s a quick rundown of the most important information you’ll find on the form:

- Total ordinary dividends (Box 1a): These are your standard dividends, taxed at your ordinary income tax rate. Depending on your tax bracket, this can vary from 10% to 37%.

- Qualified dividends (Box 1b): These are dividends that qualify for a lower tax rate. Qualified dividends are generally taxed as long-term capital gains, with a tax rate of 0%, 15%, or 20%, depending on your income.

- Total capital gain distributions (Box 2a): If your investments paid out any capital gains (like profits from the sale of assets), they’re reported here. The IRS generally treats distributions as long-term capital gains as well.

- Nondividend distributions (Box 3): These are returns of capital that aren’t taxable but can affect your cost basis in the investment.

- Federal income tax withheld (Box 4): If your broker withheld federal taxes on your dividends, that amount will show up here. (Any state taxes withheld show up in Box 14.)

If some boxes are blank on your Form 1099-DIV, don’t stress — that’s completely normal.

Form 1099-DIV instructions

Once you have your 1099-DIV in hand, you’ll need to report the income on your tax return. Here’s what you need to do:

- Double-check the numbers: Mistakes happen, even on tax forms. Review your 1099-DIV to make sure everything looks correct. If something looks off or you have questions about what the form is for, contact your financial institution right away.

- Report it on your tax return: The amounts on your 1099-DIV should be reported on your Form 1040 during tax filing. TaxAct® can help you easily report your dividend income if you e-file with us. You may also need to file Schedule B if you received more than $1,500 in dividend income.

- File it away: Keep the 1099-DIV with your tax records. You don’t need to send it to the IRS when you file, but you’ll want it handy in case the agency has any questions about your return.

FAQS about Form 1099-DIV

What’s the difference between ordinary dividends and qualified dividends?

Qualified dividends and ordinary dividends have different tax implications. A qualified dividend is an ordinary dividend that meets IRS criteria to be taxed at long-term capital gains tax rates, which are often more favorable than ordinary income tax rates.

To be considered a qualified dividend:

- The dividend must have been paid by a U.S. company or a qualifying foreign company.

- You must meet the required holding period. At minimum, you typically need to own the stock for more than 60 days within a period of 121 days, starting 60 days before the stock’s ex-dividend date (ex-date).

You can visit the IRS website for more detailed information about the requirements for qualified dividends.

When are 1099-DIV forms due?

Your financial institution should send out Form 1099-DIV by Jan. 31 of each year. If you haven’t received it by early February, it’s time to check your mailbox (or spam folder if it was sent electronically). If you’re expecting a 1099-DIV but haven’t received one by late February, contact your financial institution.

Do I need to file a 1099-DIV if I only received a small amount of dividends?

Yes. Even if you only earned a few bucks in dividends, you still need to report them on your tax return.

What happens if I don’t report my 1099-DIV income?

If you don’t report your 1099-DIV income, the IRS might come knocking, asking for the tax you owe, plus interest and possibly penalties. Just like regular income, it’s best to report your dividend income upfront to remain compliant with the IRS.

Can I deduct anything related to my 1099-DIV income?

Certain investment expenses, like investment interest or fees, might be deductible. If you aren’t sure whether you qualify to deduct these expenses, it may be worth chatting with a CPA or other qualified tax professional (did you know you can chat with real tax experts1 when you file with TaxAct?).

How to file Form 1099-DIV with TaxAct

TaxAct makes reporting your 1099-DIV income easy and straightforward. Here’s how to do it:

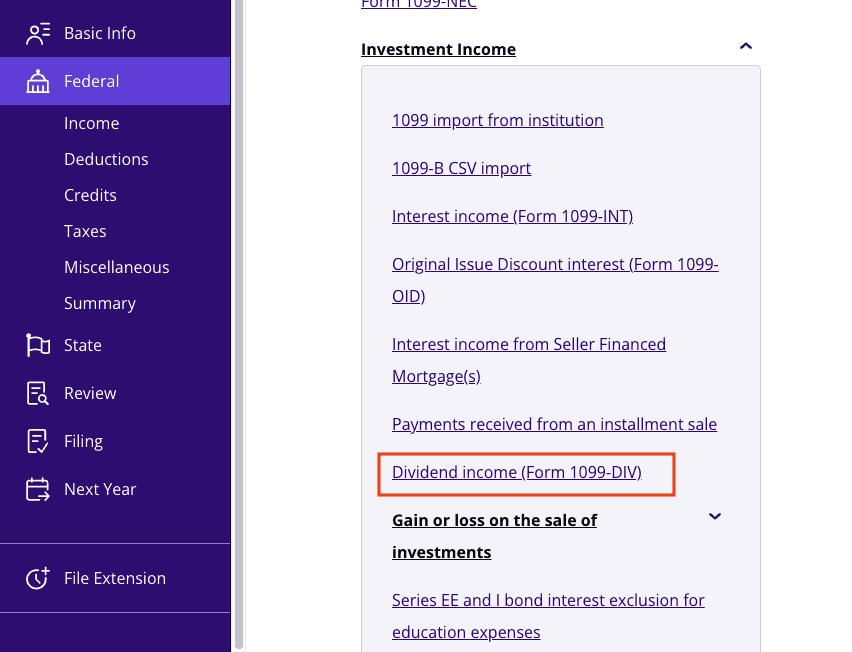

- From within your TaxAct return (Online or Desktop), click Federal. (On smaller devices, click in the top left corner of your screen, then click Federal).

- Click the Investment Income dropdown, then click Dividend income (Form 1099-DIV).

3. Click + Add Form 1099-DIV to create a new copy of the form or click Edit to edit a form already created. (Desktop program: click Review instead of Edit).

4. Continue with the interview process and enter your information from Form 1099-DIV. TaxAct will then crunch the numbers and fill out the appropriate tax forms for you. Just make sure there are no typos when entering your information!

Once you’ve entered all your info, you can e-file your return directly through TaxAct, ensuring that your tax return reaches the IRS without any postal delays.

The bottom line

Navigating the world of taxes can be tricky, but with a little know-how and help from TaxAct, you can tackle IRS Form 1099-DIV with confidence. Just remember to double-check your tax forms, report all your dividend income, and let our tax preparation software make the tax filing process as smooth as possible this year.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

1 TaxAct® Xpert Assist is available as an added service to users of TaxAct’s online consumer and SMB 1120s and 1065 product. Additional fees apply. Unlimited access refers to an unlimited quantity of expert contacts available to each customer. Service hours limited to designated scheduling times and by expert availability. Some tax topics or situations may not be included as part of this service. Review of customer return is broad, does not extend to source documents and is not intended to be comprehensive; expert is available to address specific questions raised by customer. View full TaxAct Xpert Assist Terms and Conditions.

The post Form 1099-DIV: What It Is and How to Report Dividend Income appeared first on TaxAct Blog.

Read MoreBy: Meghen Ponder

Title: Form 1099-DIV: What It Is and How to Report Dividend Income

Sourced From: blog.taxact.com/guide-to-1099-div-form/

Published Date: Wed, 18 Sep 2024 16:46:12 +0000

----------------------

Did you miss our previous article...

https://trendingintaxation.com/taxes/understanding-your-tax-refund-a-comprehensive-guide