Welcome to the exciting world of the gig economy, where flexibility meets opportunity — and more tax obligations.

The gig economy has exploded in recent years, with more taxpayers opting for the freedom and autonomy of self-employment. Whether you’re a rideshare driver, content creator, Etsy® or eBay® seller, or working odd jobs, understanding your gig economy tax obligations is essential.

This guide will walk you through everything you need to know to navigate the tax filing process as a gig economy worker. From tax rules on estimated tax payments to deductions and self-employment tax, we’ve got you covered. Plus, we’ll link you to detailed guides tailored to specific gig jobs to make tax season as painless as possible. Let’s dive in!

Getting started with gig taxes

Let’s clear up a common misconception: Just because you’re not a traditional Form W-2 employee doesn’t mean you’re off the hook when it comes to taxes. The IRS considers most gig workers as self-employed people, meaning you’re responsible for reporting your side income and paying taxes on gig income.

Here’s what that means for you:

- You can deduct business expenses to lower your taxable income.

- You must report all income from gig work.

- If you expect to owe at least $1,000 in taxes for the year, you may need to make estimated tax payments.

- If you made at least $400 in self-employment income, you must pay self-employment tax (15.3%) to cover Social Security and Medicare.

Self-employed tax forms for gig workers

If you’re self-employed, you’ll likely deal with the following tax forms:

| Form | Purpose |

| Schedule C (Form 1040) | Reports self-employment income and expenses. |

| Form 1099-NEC | Reports nonemployee compensation ($600+) from clients. |

| Form 1099-K | Reports payments processed through third-party platforms. |

| Schedule SE | Calculates self-employment tax (Social Security & Medicare). |

| Form 1040-ES | Used to make estimated tax payments. |

For a deeper dive into the self-employed tax forms above, check out our Guide to Self-Employed Tax Forms.

How to file taxes as a gig worker

Filing taxes as a gig worker may seem complex, but it doesn’t have to be. Let’s start by breaking everything down into manageable steps.

1. Determine your tax status.

Before filing, you need to understand how the IRS classifies your gig work. Most gig workers fall into one of the following categories:

- Independent contractor or freelancer – You provide services to clients but don’t receive employee benefits.

- Sole proprietor – You operate a business under your own name without forming a separate legal entity.

- Limited liability company (LLC) – You have registered a business to separate personal and business liability.

For tax purposes, the IRS considers independent contractors, sole proprietors, and single-member LLCs as self-employed, meaning you’ll file Schedule C with your Form 1040 income tax return.

If you’re unsure whether your gig is a hobby or a business, ask yourself:

- Do I regularly earn income from this activity?

- Do I intend to make a profit?

- Do I put time and effort into growing my gig work?

If the answer is yes to the above, the IRS will likely classify your gig as a business. Congrats! This means you can claim deductions to lower your tax bill.

2. Keep track of income from all sources.

Unlike traditional W-2 employees, gig workers don’t have taxes withheld from their paychecks, so you must track your own earnings.

Common ways gig workers receive income:

- Direct payments – Bank transfers, Venmo®, PayPal®, or Cash App®.

- Platform-based earnings – Uber®, Lyft®, Etsy, eBay, YouTube®, TikTok®, etc.

- Freelance work – Payments from clients, brand partnerships, or content sponsorships.

Understanding tax forms for gig workers:

- Form 1099-NEC – Issued by clients who paid you $600 or more in nonemployee compensation (previously reported on Form 1099-MISC).

- Form 1099-K – Issued by third-party payment processors (e.g., PayPal, Venmo, eBay, Etsy) if payments exceed $5,000 in tax year 2024 ($2,500 in 2025, $600 in 2026).

- No tax form? – Even if you don’t receive a 1099, you must still report all income on your tax return.

Tax Tip: Keep a spreadsheet or use accounting software to track your income throughout the year to avoid scrambling at tax time.

3. Track deductible expenses to lower your taxable income.

One of the biggest tax benefits of gig work is deducting business expenses to reduce your taxable income. To qualify, expenses must be:

- Ordinary – Common in your industry (e.g., mileage for a rideshare driver).

- Necessary – Essential for running your gig work.

Common gig worker tax deductions:

Gig work often comes with unique expenses. If you’re seeking to maximize your tax savings, it helps to know about tax deductions available for freelancers and gig workers. Some common ones that might apply to you include:

- Self-employment tax deduction – You can deduct 50% of your self-employment tax (the portion that an employer would typically cover).

- Home office deduction – If you have a space used exclusively and regularly for business, you can deduct a portion of your rent, utilities, and internet.

- Health insurance premiums – These are only deductible if you pay for your own coverage and are not eligible for an employer-sponsored plan (includes medical, dental, vision, and even qualifying long-term care insurance).

- Phone and internet bills – You can deduct only the percentage of your phone usage for business, or 100% if you have a dedicated business phone line.

- Office supplies & equipment – Includes laptops, printers, software, business subscriptions, etc.

- Advertising & marketing – Website hosting, paid social ads, business cards, etc., can be deductible when used for business purposes.

Tax Tip: Always use detailed record-keeping, receipts, and mileage logs — these can make or break your deductions in the event of an IRS audit. Using a separate bank account or credit card for your business can help you track expenses more easily.

4. File the correct tax forms.

Since gig workers don’t receive a W-2, you’ll need to file additional tax forms:

- Schedule C (Form 1040) – Reports gig income and deductible expenses.

- Schedule SE (Self-Employment Tax) – Calculates Social Security & Medicare taxes.

- Form 1040-ES – Used to make quarterly estimated tax payments if you expect to owe over $1,000 in taxes for the year.

TaxAct Self-Employed makes filing these tax documents a breeze. Our user-friendly tax preparation software walks you through reporting your self-employment income and business expenses.

Tax Tip: If you formed an LLC or S Corp, you may need to file additional forms, such as Form 1065 for partnerships or Form 1120-S for S corporations. Don’t worry, though — TaxAct Business can help you with these.

5. Pay estimated taxes to avoid IRS penalties.

Since no employer withholds taxes from your gig income, you’re responsible for paying taxes yourself throughout the year. You must pay estimated taxes quarterly if you expect to owe $1,000 or more during the year.

Quarterly estimated tax due dates:

- April 15 – For income earned January through March

- June 15 – For income earned April through May

- Sept. 15 – For income earned June through August

- Jan. 15 (following year) – For income earned September through December

If any of the above dates fall on a weekend or holiday, the due date becomes the next business day.

How to calculate estimated taxes:

- Add up your total expected gig income for the year.

- Subtract your estimated deductions to find your taxable income.

- Calculate self-employment tax (15.3% ) + income tax (tax rate is based on your tax bracket).

- Pay 25-30% of your net income in quarterly tax payments.

Need help with your tax calculations? Try out our Income Tax Calculator and Self-Employment Tax Calculator.

How to make payments:

- Online: Use IRS Direct Pay or the Electronic Federal Tax Payment System (EFTPS).

- Tax software: Did you know TaxAct can calculate and set up automatic estimated tax payments for you?

- Mail: Print Form 1040-ES and send a check to the IRS. TaxAct can help you print quarterly payment vouchers. Once printed, just mail the voucher and your check or money order to the IRS by each due date.

Tax Tip: If you also have a W-2 job, you can increase your tax withholding to cover gig work taxes instead of paying estimated taxes separately. Some people find this easier!

6. Use tax software to simplify the process.

An easy way to file gig worker taxes is by using TaxAct Self-Employed. Our product walks you through:

- Entering gig income from Form 1099-NEC, Form 1099-K, or manual entries.

- Claiming business deductions to lower your tax bill.

- Calculating estimated taxes for next year.

- E-filing your return directly to the IRS.

How to file gig worker taxes with TaxAct

Using TaxAct makes filing self-employment taxes a breeze. Here’s how to enter your Schedule C information:

- Log in to TaxAct (Online or Desktop).

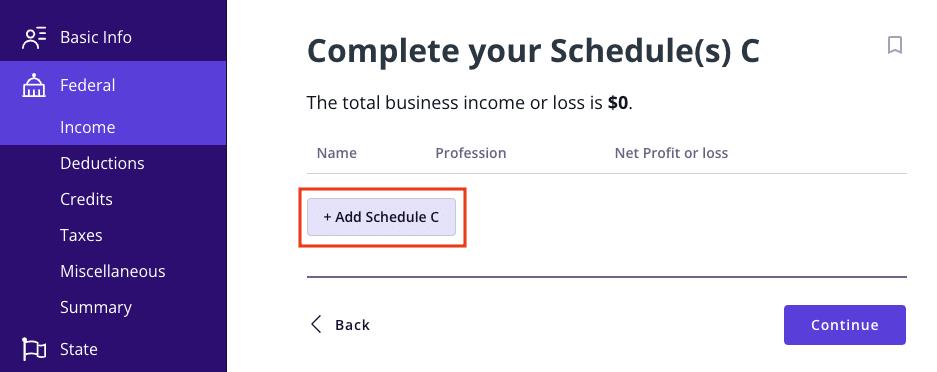

- Click Federal > Business Income > Business Income or Loss from a Sole Proprietorship, as shown below.

- Click + Add Schedule C, as shown below, to create a new copy of the form, or click Edit to edit a form already created. (Desktop program: click Review instead of Edit.)

- Continue with the interview process to enter your information.

Tax Tip: If you’re worried about missing deductions, TaxAct’s Deduction Maximizer1 will flag potential missed savings before you file.

Gig worker tax guides by profession

Each type of gig work comes with some unique tax considerations. Whether you’re selling on an online marketplace, driving for Uber, creating digital content, streaming on Twitch®, or even selling feet pics, you need to know how to report your income and maximize deductions. Below, we’ve broken down the essentials for each gig profession, complete with links to in-depth guides to help you file confidently.

eBay seller taxes: Understanding 1099-K reporting and deductions

Read our complete eBay tax guide here.

If you’re selling on eBay, whether as a hobby or full-time small business owner, your income may be taxable. The IRS distinguishes between personal sales and business sales, and knowing where you fall is important.

- Do eBay sellers need to pay taxes?

- Selling used personal items at a loss? No tax owed.

- Selling for a profit? You owe taxes on the gain.

- Regularly reselling for profit? You’re a business and must report all income.

- Common tax deductions for eBay business sellers:

- Shipping costs and packaging materials

- Transaction and platform fees

- Cost of goods sold (COGS)

- Storage and inventory tracking systems

- How to report eBay income:

- Business sellers report income on Schedule C and may owe self-employment tax.

Etsy seller taxes: Reporting online craft sales to the IRS

Read our full Etsy tax guide here.

Do you sell handmade goods, digital products, or vintage items on Etsy? If so, your earnings are self-employment income and must be reported on your tax return.

- Key tax obligations for Etsy sellers:

- You must file a tax return if you earn $400+ in net self-employment income.

- Self-employment tax (15.3%) and income tax applies to net earnings.

- Some essential deductions for Etsy sellers:

- Supplies

- Etsy fees

- Advertising

- Shipping materials

- Home office expenses

- How to file Etsy income:

- Use Schedule C to report income and claim expenses.

Odd jobs and weird gigs: Reporting side hustle income

Read our full odd job tax guide here.

This guide is a great catch-all for those who are juggling a few random gigs or trying something new — and it’s packed with real examples to help you get it right during tax season.

Whether you’re making money from Twitch streaming, walking dogs, babysitting, freelancing on Fiverr®, or even selling feet pics online (yes, really) you’re probably earning taxable self-employment income.

Here’s what you need to know if your side hustle doesn’t quite fit in a box:

- Every dollar counts: Even if you don’t receive a Form 1099, the IRS expects you to report all income.

- Self-employment tax: If you earn over $400 across all side hustles, you owe self-employment tax to cover Social Security and Medicare taxes.

- Yes, dog walking counts: Earnings from platforms like Rover® or direct clients must be reported and may trigger self-employment tax.

- Streaming is a business: Twitch income from Bits, ad revenue, or donations is self-employment income and should go on Schedule C.

- Cash jobs are still taxable: Babysitting, tutoring, or mowing lawns? If someone pays you, that’s income, even if you’re paid in cash “under the table.”

- Claim your write-offs: Depending on the job, you may be able to deduct platform fees, supplies, pet gear, marketing, grooming, or software subscriptions.

- Don’t skip quarterly payments: You may need to pay estimated taxes every quarter to avoid underpayment penalties.

Lyft and Uber driver taxes: Maximizing deductions for rideshare drivers

Read our full Uber and Lyft tax guide here.

As an independent contractor for Uber, Lyft, or a food delivery service like DoorDash®, you’re responsible for tracking your income and paying your own taxes.

- Do Uber and Lyft take out taxes?

- No. Drivers must set aside money for income and self-employment taxes.

- If you expect to owe $1,000+ in taxes, you should make estimated quarterly tax payments.

- Understanding Form 1099-K and 1099-NEC:

- 1099-K reports gross trip earnings.

- 1099-NEC is issued if you earn $600+ in non-driving earnings (bonuses, incentives, referral payments, etc.).

- Maximizing tax deductions:

- You can take the standard mileage deduction or deduct actual vehicle expenses (fuel, maintenance, insurance, etc.)

- Parking fees and tolls during work

- Car loan interest

- Equipment and passenger amenities like phone mounts, chargers, and streaming subscriptions

- How to file Uber & Lyft taxes:

- Report earnings and business-related expenses on Schedule C and pay self-employment tax.

Content creator taxes: Filing taxes as a YouTuber, influencer, or social media star

Read our complete content creator tax guide here.

If you earn money from YouTube, Instagram®, TikTok, or brand sponsorships, you must report all income to the IRS.

- Do content creators pay self-employment tax?

- Yes, if you earn $400+ in net self-employment income, you owe self-employment tax (15.3%).

- You must pay estimated taxes quarterly if you expect to owe $1,000+ in taxes.

- Understanding 1099-NEC and taxable free products:

- If a brand pays you $600+, they must issue Form 1099-NEC.

- Free products worth $100+ may be taxable if received in exchange for promotions.

- Tax deductions for influencers:

- Home office expenses

- Photography & video equipment (cameras, ring lights, tripods)

- Marketing & advertising, like paid social media promotions

- Business travel expenses

- How to file as a content creator:

- Report income and expenses on Schedule C with Form 1040.

FAQs about gig worker taxes

Do I need to pay taxes if I don’t get a 1099?

Yes, the IRS requires you to report all income, even if you don’t receive Form 1099-NEC or 1099-K. Make sure to track all income and keep good business records to minimize headaches when tax season rolls around.

How do I tell if I am self-employed?

The IRS generally considers you to be a self-employed individual if you fit into any of the following categories:

- Independent contractor or freelancer

- Sole proprietor

- Limited liability company (LLC)

- Member of a partnership

Even if you work part-time for one employer while freelancing for various clients, you still fall under the self-employed category.

Still not sure? Check out How to Tell If You Are Self-Employed.

How do I calculate self-employment tax?

Self-employment tax is 15.3% of your net earnings (12.4% for Social Security and 2.9% for Medicare). You can deduct half of this tax on your federal tax return.

Is hobby income different from gig income?

Yes! Tax implications vary depending on whether your side gig is a hobby or a business.

Here’s the gist: If your side gig is a business, you can claim tax deductions for things like startup costs, travel, and internet bills. But if your side gig is just a hobby, you won’t be able to claim tax deductions to offset associated costs.

The IRS typically considers you a business if you’re making a profit regularly.

How can I lower my tax bill as a gig worker?

To save on taxes, do your best to maximize your deductions, contribute to a self-employed retirement plan if you qualify, and keep accurate records to ensure you claim every eligible tax break.

What happens if I don’t pay estimated taxes?

You could face IRS penalties for underpayment if you don’t pay estimated taxes by the deadline every quarter. To avoid this, make quarterly estimated tax payments if you expect to owe at least $1,000 in taxes during the year.

If you work full-time, consider asking your employer to withhold additional taxes from your paychecks to cover your side gig taxes, if that’s your preference.

How much should I set aside for estimated tax payments?

Setting aside 25-30% of your self-employment income is generally recommended to cover your tax obligations.

The bottom line

Filing taxes as a gig worker doesn’t have to be scary. By understanding your tax obligations, keeping detailed records, and claiming available deductions, you’ll be breezing through tax season with confidence.

If you need help filing, TaxAct Self-Employed guides you through the process step-by-step, ensuring you claim every deduction you’re entitled to. Ready to knock out your gig worker taxes? Let’s start filing.

This article is for informational purposes only and not legal or financial advice.

All TaxAct offers, products and services are subject to applicable terms and conditions.

All trademarks not owned by TaxAct, Inc. that appear on this website are the property of their respective owners, who are not affiliated with, connected to, or sponsored by or of TaxAct, Inc.

1TaxAct’s Deduction Maximizer guides you step by step through the process of completing your return in a way that helps you uncover additional tax advantages and helps you maximize your deductions by checking dozens of additional deductions we know from experience folks don’t think to look for. Each deduction you claim may reduce the amount of tax you owe, resulting in a lower IRS bill overall.

The post Comprehensive Guide to Filing Taxes as a Gig Worker appeared first on .

Read MoreBy: Meghen Ponder

Title: Comprehensive Guide to Filing Taxes as a Gig Worker

Sourced From: blog.taxact.com/guide-to-filing-gig-worker-taxes/

Published Date: Mon, 21 Apr 2025 15:58:00 +0000

----------------------